Ark Kapital aims to break down financial barriers and empower entrepreneurship through building the ‘best financing solutions’ for tech businesses.

Quartr, a Stockholm-based app platform that gives retail investors on-the-go access to company information raised $4.5M.

Swedish fintech Anyfin has raised a $30mn series B round led by EQT Ventures with participation from Accel, Northzone, Fintech...

Lloyds Bank partnered with Swedish fintech Minna Technologies and Visa in 2020 to launch its subscription management service, which allows Lloyds Bank customers to view, manage or amend their subscription services through the app.

Swedish based digital banking startup Tink has raised $64mn at a $270mn valuation; the new capital was led by Insight...

SweepBank has announced it is using Tuum, a next-generation banking platform, to deliver what it calls the Netflix experience to banking.

International payments network Swift has created their alternative to blockchain which they believe is a better, more reliable solution; global...

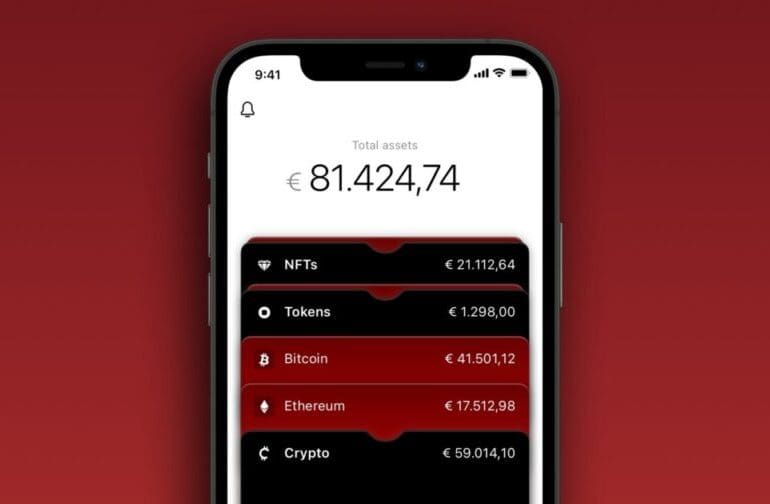

Numbrs’ Bitcount Accounts has been designed to be fully anonymous, with no company access to account or client details

Swiss fintech company Numbrs has blamed jealous banks for killing off its original business model as a third-party provider of financial products. So it has reinvented itself under the banner of the ultimate bank killer – bitcoin.

The Federal Council of Switzerland is seeking to make the regulatory framework more flexible for fintech companies; they have instructed the Federal Department of Finance to devise a policy statement setting such a direction; recommendations to be considered include: (a) setting a maximum of 60 days for holding money in a settlement account, which will make settlements better aligned with crowdfunding project funding deadlines, (b) creating of an innovation sandbox in which a platform can accept funds up to CHF 1 million, and (c) establishing a new fintech license, with fewer restrictions than on traditional banks. Source