U.S. based growth investor, Motive Partners, recently opened their European hub in Canary Wharf, London as they see the market as one of the epicenters of financial services; this is the latest sign that London has not lost their attractiveness since Brexit; a few additional reasons for being a destination include experience with the new open banking regulations and the Financial Conduct Authority (FCA) has been very supportive of fintech. Source.

Today, many DeFi platforms have employed protocols that make it easy to support more than one network. However, there is still the problem of interoperability. This prompted Hashbon to build the first-ever cross-chain decentralized exchange known as Hashbon Rocket to fix this problem. This development is very important for the DeFi sector because most decentralized...

Goldman Sachs Shares Move Higher As Earnings Top Expectations, Marcus Adds More Than 3 Million Users

Goldman Sachs (NYSE:GS), the words most prominent investment bank and aspiring global Fintech, announced Q1 earnings today that topped estimates.

A new audit by KPMG shows that Wirecard’s core business in both Europe and the Americas was losing money for...

Business Insider shares data on total funds raised by UK-based digital only banks; Atom Bank leads in total funding and is reportedly in process of closing another 100 million British pounds ($124 million) in equity which would bring their total raised to 235 million British pounds ($294.6 million); other players include Tandem Bank, Starling Bank, Monzo, N26 and Monese; Monzo is also in the process of raising money with a Series C funding round. Source

IW Capital has surveyed 1,000 investors who have between GBP10,000 ($12,812) and over GBP250,000 ($320,300) worth of investments; the report shows UK investors are willing to take on greater risk in 2017; 44% of investors think Brexit will have a positive impact on their investment strategy; many investors see investment opportunity in private equity and UK investors also reported they will be looking more to tax efficient investing. Source

NatWest’s multi award-winning open banking payments solution Payit, has successfully made its first Variable Recurring Payment...

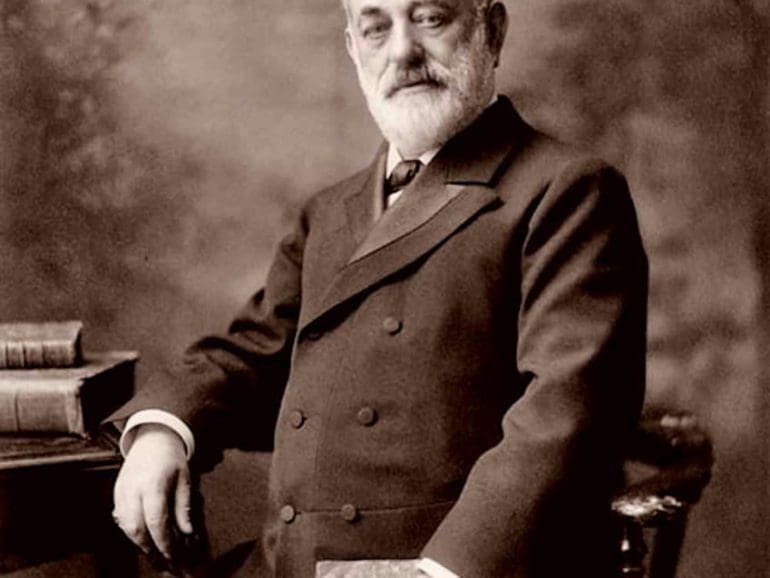

Businessagent.com is seeking to raise between 200,000 British pounds and 750,000 British pounds through a fundraising campaign on Angels Den; the platform currently aggregates and facilitates equity crowdfunding and debt financing; the firm plans to use the funds to improve user data, expand its broker and sales team, build new relationships and develop a secondary market; on December 8 the firm received investment from Malcolm Burne, who will support the firm's plans for a secondary market; Burne is an expert in secondary market trading for private investments. Source

Swedish buy now, pay later giant Klarna is to let go of approximately 10% of its global workforce due to ongoing challenging global economic conditions.

Credit platform MarketFinance has secured debt financing from Deutsche Bank to partly fund £100m of loans to SMBs in the UK.