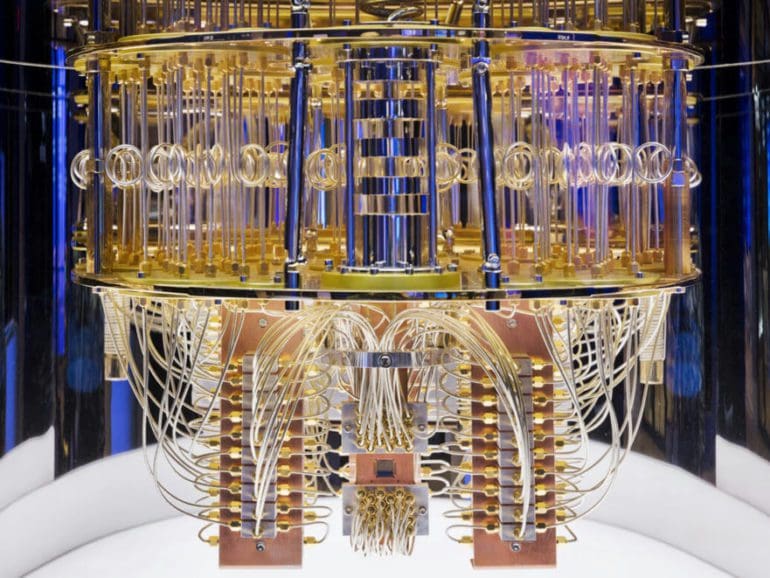

HSBC has joined forces with technology giant IBM to explore applications of quantum computing in the financial services space.

HSBC has moved 3000 members of its staff into a new building and are viewing this digital group differently than their core suit-and-tie employees; the bank believes separating them out will better help to fuel new innovative ideas; HSBC CEO Stuart Gulliver said, "To survive for 150 years we've had to evolve. Most of the risk we've dealt with is political. Actually what's happening in the digital space is there is a threat, particularly to retail banking... in payments, in wealth management." Source

MarketInvoice inked another bank deal with Varengold Bank AG for £45mn ($60mn) in debt funding; according to AltFi MarketInvoice's capacity to take on institutional money has increased four fold since 2014; MarketInvoice have funded over 70,000 invoices and lent out over £1.5bn ($2bn). Source.

Beijing is trying to revive a long dormant stock-exchange link with Europe, after years of unsuccessful attempts to lure multinational companies to list their shares in China....

Just two peer-to-peer lenders have been authorised to offer the recovery loan scheme (RLS). Funding Circle and Assetz Capital are the only two P2P platforms accredited to offer funding under the government-backed scheme, out of 74 approved firms. In contrast, the coronavirus business interruption scheme – which preceded the RLS – included more P2P platforms...

Raisin, a leading German provider of open banking for savings and investment products, says it now has more than €25bn in assets under management (AUM) in savings products.

The new client house branch will allow retail, business and private banking customers to enjoy coffee and receive personal service; “A client house to me should feel like home,” comments Erik Van Den Eynden, CEO of ING Belgium, to Banking Technology; the branch has all the banks’ typical functions and meeting rooms complete with screens for video conferencing; the company will attempt to open about 15 by end of 2020. Source.

The popularity of crypto is rising. Stablecoins have presented a significant opportunity for settlement, but how should banks respond?

Caxton, which claims to be a profitable payments Fintech, has secured 151% (£1,512,752) of its £1M fundraising target from 1011 investors (at the time of writing) via Crowdcube. Caxton, which says it has a great team and proven technology and further claims that 500k+ B2B

Online lender Welendus has announced a Seedrs campaign with targeted fundraising of 300,000 British pounds ($375,060); firm provides short term financing options at affordable rates; plans to launch in the first quarter of 2017. Source