The agreement was signed by the Financial Conduct Authority (FCA) and the People's Bank of China, the intention of the deal is to strengthen regulatory cooperation and boost market access for fintech startups in both markets; the "Fintech Bridge" as it is being called will allow the countries to share information about financial services and help to spot emerging trends in each market. Source

BNP Paribas Asset Management was able to complete a fund distribution test using blockchain technology; the test used BNP Paribas Securities Services’ blockchain programme, Fund Link and FundsDLT; as AltFi reports the test was able to show Fund Link connecting to other blockchains and the transaction completed each part of the fund trade process, from order delivery to trade processing; this continues a trend from BNP Paribas Asset Management as they have also launched a specialist fund for fintech investment and began updating their legacy technology. Source.

Russia's invasion of Ukraine triggered a rapid wave of sanctions, bringing challenges for financial services firms looking to stay compliant.

The exchange will also set up a regional headquarters in Dubai.

In a LinkedIn post, Sukhwinder Shoker provides insight into MarketInvoice's loan book which the company shares publicly; analysis includes data on originations and advance rates, invoice terms, risk-price grade, gross discount rates, diversification and net returns; according to Shoker's analysis, the average monthly net return achieved since January 2012 by investors before fees and tax is 50 basis points. Source

Payrails, a Berlin-based fintech, exited stealth mode today after securing $6.4m in funding led by a16z.

The European Fintech Association (EFA) has launched with six founding members: Funding Circle, Raisin, Finleap, Transferwise, Moneyfarm and N26; these...

Bpifrance adopts October Connect technology , to speed up its decision making process while reducing risk.

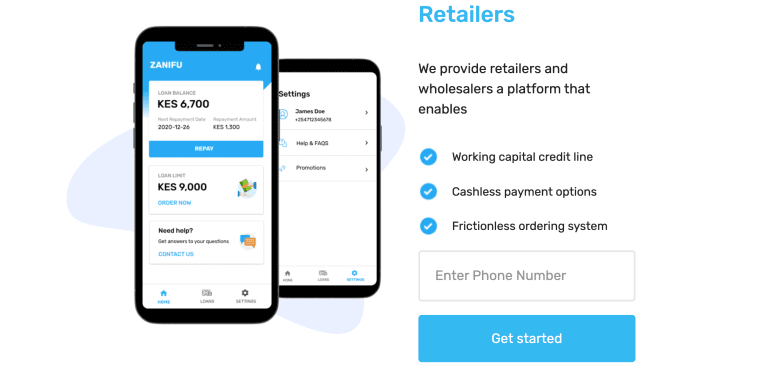

Kenyan fintech Zanifu is set to upgrade its platform and grow the number of micro, small and medium enterprises (MSMEs) it extends stock-financing to after securing $1 million in Seed funding. Saviu Ventures, which invested in the startup’s pre-seed round early 2020, Launch Africa Ventures, Sayani Investments and a number of angel investors from Kenya...

Blocksure is looking to bring the beneficial aspects of blockchain technology to the insurance market; according to Coverager, Blocksure has developed an insurance policy delivered by a SMART contract; SMART stands for see-through, multifaceted, authoritative and real-time; this would enable insurers and the many parties involved in a transaction to use one centralized location for the contract; this would be a more efficient and secure way to operate; we are likely to continue to see blockchain based proof of concepts across the insurance space in the future. Source