Minna Technologies has announced a partnership with Steven, the financial health app touted as the "best way" to keep track of shared expenses.

The Bank of England's Financial Policy Committee discussed concerns over consumer credit defaults in its recently released minutes; credit card, bank loan and car loan borrowing has increased and the Bank is also concerned about prolonged interest free offers and eased underwriting standards; stress testing has revealed potential losses for banks of 18.5 billion British pounds ($23 billion) on their consumer credit loans and 11.8 billion British pounds ($15 billion) on their mortgage loans; as the Bank monitors consumer lending, it is likely new constraints will be required to manage risks in the new economic environment. Source

COVID-19 has brought challenging years for SMEs. With inflation rates at an all-time high, alternative lenders become key to their survival.

Stockholm, Sweden has announced it will be opening a fintech hub; leading developers of the Stockholm Fintech Hub include Matthew Argent of BLC Advisors, KPMG, NFT Ventures and Invest Stockholm; the Stockholm Fintech Hub is currently seeking partners and will be led by a steering committee including the Fintech Hub's developers; motivation from the developers for a fintech hub was driven by an ecosystem of fintech startups and high growth companies in the country; according to lead developer, Matthew Argent, the Stockholm Fintech Hub will seek to maintain standards and evolve the support ecosystem that provides resources for fintech companies. Source

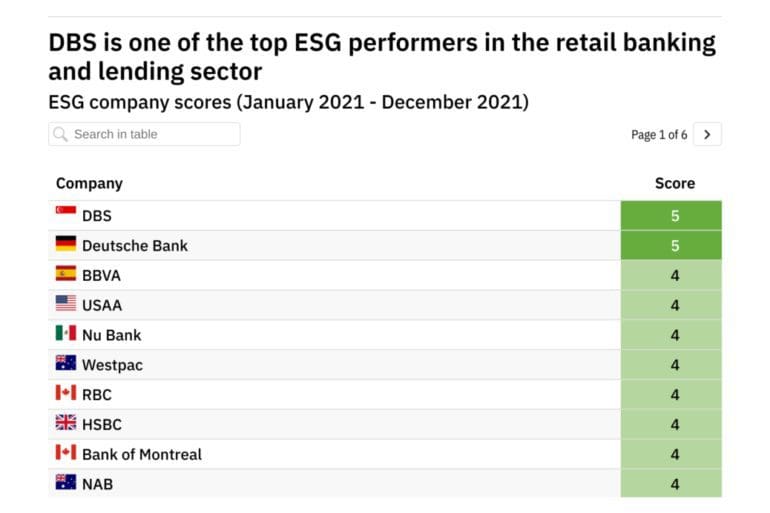

GlobalData research reveals which banks are best placed to benefit from ESG disruption within the retail banking sector

Lloyd’s Banking Group and Royal Bank of Scotland announce the closure of more than 100 branches; this is part of a wider trend for both banks who will now have closed more than 1,000 in the last few years; reasons for the closings include more UK consumers using mobile banking and the branch closures help to save significant costs. Source.

UK based Tide is already the largest digital SME bank and now the startup is set to pass the Cooperative...

Rocket Internet is looking to make an investment push into fintech and artificial intelligence as it looks to deploy $3bn...

As economic conditions worsen, Nucleus has launched Pulse, providing SMEs with critical insights on their business health.

Moss is a payment and credit card platform that enables companies to optimise their finances.