As more financial services firms beginning using Google, Amazon and Microsoft for cloud based services regulators are starting to take...

The UK has officially left the EU and while most of 2020 will be a transition time fintech and bank...

The list covers all industries, but includes the fastest growing financial services businesses in Europe; TransferWise came in at #24, reporting 3,392% revenue growth from 2013-2016; the company hired 670 people over the same time period. Source

According to Michael Kent, CEO of Azimo, a recent survey says 77 percent of UK residents are stressed about money;...

Finexcap, an online invoice financing platform, has partnered with Sage to expand its customer base; through the partnership the two firms have created Sage Clic&Cash; Sage Clic&Cash will offer invoice financing to approximately 600,000 small business clients using the software product Sage or Ciel. Source

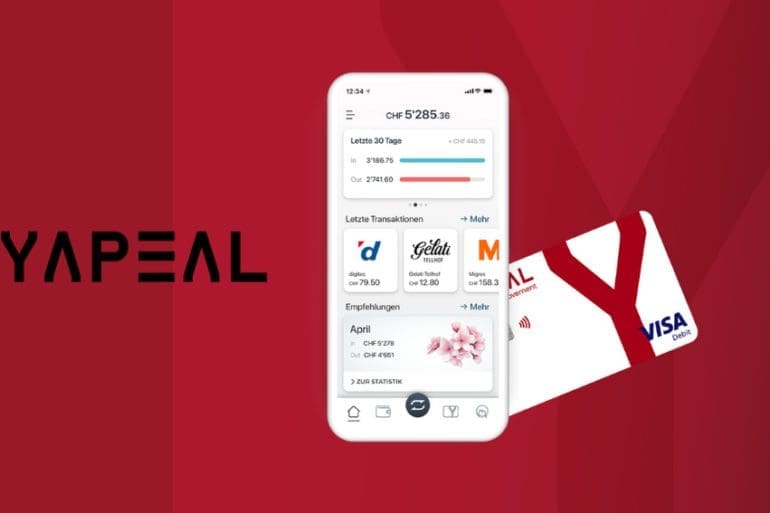

YAPEAL announced that FINMA has granted it a license extension to offer cross border services to international customers.

Full article was published in Helsinki Fintech Guide 2021. According to Pia Santavirta, Managing Director of the Finnish Ventur

An inclusive workplace mirroring an inclusive society: Fintech is a force for innovation and change, posing significant opportunities in supporting equal rights and benefiting from the voices of a diverse workforce.

80 percent of UK consumers were unaware of the term fintech; a new study by the Telegraph shows that fintech knowledge and adoption is surprisingly low; even larger name brands like Funding Circle, Atom Bank and Nutmeg were not known to most surveyed consumers; the results point to an uphill climb by industry participants. Source.

Nutmeg has received 12 million British pounds ($14.74 million) in capital from investor Taipei Fubon Bank; the 12 million British pound fundraise follows a Series C fundraising round in November led by Convoy Global Holdings; the funding will help to support the firm's rapid growth; assets under management for its robo advisor service have been increasing significantly and are now at approximately 600 million British pounds ($736.85 million); success has been driven by demand for its discretionary investment management service which also offers low fees. Source