HSBC has shared insight from the development of its HSBC SmartSave app which it developed within the Financial Conduct Authority's Regulatory Sandbox initiative in partnership with Pariti; the app provides personal finance management services using algorithms and four customer plans; overall the app has proved successful, saving customers 63.17 British pounds ($78.80) per month; of the four service plans HSBC reported "Rounding Up" to be the most popular, allowing customers to round up purchases to save spare change on transactions. Source

HSBC UK has agreed to a partnership with consents.online, an Account Information Service Provider or AISP; the partnership is the...

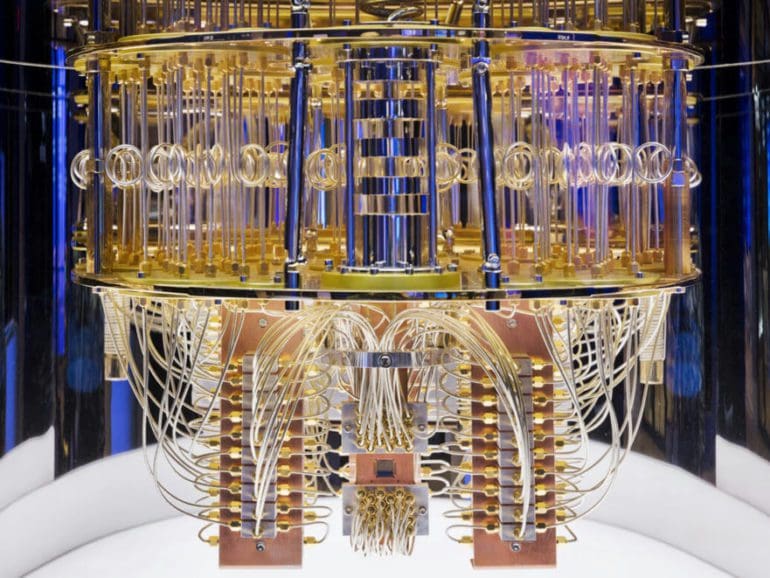

HSBC has joined forces with technology giant IBM to explore applications of quantum computing in the financial services space.

HSBC intends to launch a new product in 2018 to address problems they see in the automated investment market; the new product is dubbed robo-advising 2.0 by Dean Butler, HSBC’s head of retail wealth; it will provide holistic financial advice and will eventually include recommendations for other products such as pensions and insurance. Source

HTEC has acquired Mistral, pushing further their plans for global expansion and making it the largest tech company in Bosnia and Herzegovina.

The idea behind Humaniq was to bring the underbanked, a number that estimates around 3.5 billion worldwide, into the banking world; in an interview with the Huffington Post, Humaniq CEO Dinis Guarda talks about the solution they are bringing to the market; they are working with emerging economies where people live on $2.50 a day and have access to a smartphone; the Humaniq banking app will allow these individuals to have access to chats, wallets, payments, microloans and peer-to-peer lending services; they are doing an initial test in Ghana, allowing users to chat and make payments with their phones to local merchants; offering the underbanked a solution is something that can help lift communities and ultimately countries out of poverty. Source

Hyper-automation in business processes and financial services deliver significant value as technologies improve.

i2c Inc., a provider of digital payment and banking tech, has announced its partnership with BEYON Money, the mobile super app introduced by Batelco Financial Services, which is the Fintech unit of Bahrain’s digital solutions and telecommunications provider. Backed by a recently-secured Open Banking license

ID Finance will collaborate with Yuri Popov and asset manager Da Vinci Capital to launch the FinTech Credit Fund; estimated fund value is $200 million with debt financing focused on fintech and alternative lending; ID Finance is a growing fintech firm with three businesses: MoneyMan, Ammopay and Solva. Source

Business Insider caught up with ID Finance co-founder and CEO Boris Batin at LendIt Europe; the company hopes to raise around $100 million through bond issuances over the next year; to date ID Finance has raised $10 million in equity and $70 million in debt; the startup is based Barcelona and lends in Russia, Spain, Kazakhstan, Georgia, Poland, Brazil and Mexico; ID Finance has lent $300 million so far. Source