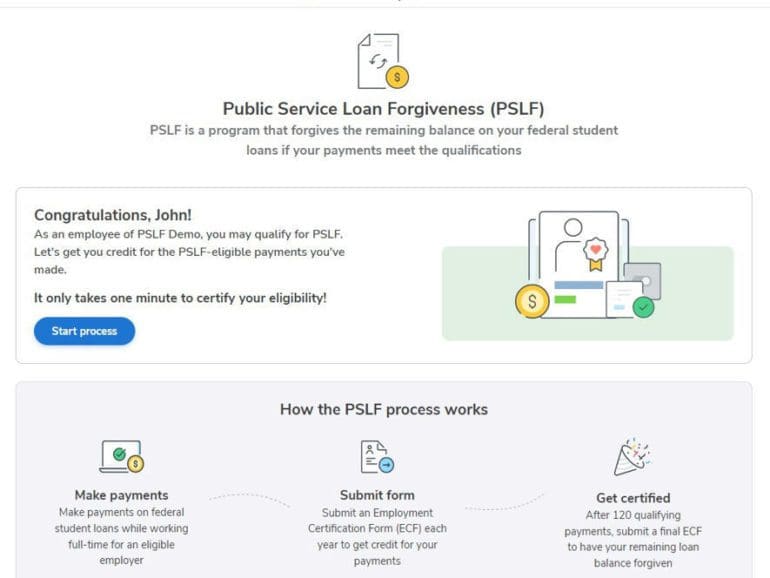

This fall's looming student debt crisis will bring the worst environment we've seen in decades. There's a way out for many, but few people are aware of it.

Between the Public Service Loan Forgiveness deadline and the end of the student loan payment moratorium, borrowers are flocking to Candidly.

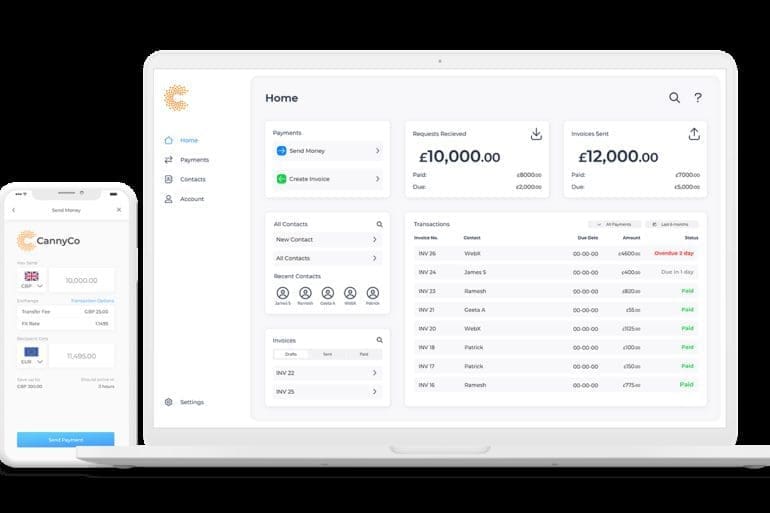

Today, the eight finalists pitched virtually in front of several leading VCs, and one came out on top. At the finale of the pitch competition, Canny Co took the gold prize.

The fintech community's one-stop-shop for all things lending and digital banking. Conferences, podcasts, news, webinars, & white papers showcasing the latest in fintech.

The early-stage fund will invest in infrastructure projects for blockchain developers.

Capgemini's "World Fintech Report" provides insight on fintech and its current collision with traditional financial service providers; report says that fintech is both overhyped and underestimated; Capgemini points out the success of fintech while noting the industry's small percentage of business versus traditional firms; provides details on how fintech firms are partnering with traditional firms and how fintech is evolving to become a more significant part of traditional firms; highlights the growth potential ahead for the fintech industry; notes how traditional firms are approaching fintech partnerships and investment; says 59.2% of traditional finance firms are developing their own in-house capabilities and 60% are establishing partnerships with innovative fintech firms. Source

Capify is a small business lender serving the UK and Australian markets; the company makes online merchant cash advances as...

The company raised $22 million as an extension to its $45 million Series C in August 2017; Capital Float raised $80 million of debt in the last 12 months used to finance its small business loans in India; Capital Float’s customer base includes 80,000 people in 300 cities; they currently complete 10,000 loans per month and have an outstanding loan portfolio of $170 million; their default rate is around 2% and loans are between $376 and $7,530. Source

With demonetization in full swing, Capital Float has expanded their loan offerings to include businesses with card machines; the new program will allow vendors to take out a loan of up to 200% of their sales; loans will then be paid back based on a small fee from each transaction; the company expects a surge in loans based upon the new government program to remove large cash notes. Source

For incumbents, changing existing financial infrastructure systems is like taking the engine out of the plane in mid-air.