It all started with a cold LinkedIn message back in 2016. The co-founder of the (then) tiny startup Nova Credit,...

Penny Crosman takes a deep dive into the big news story of the week with analysis of the pending LendingClub...

To many — if not most — fintechs, data is a lifeblood that powers innovative underwriting, analytics, product development, and...

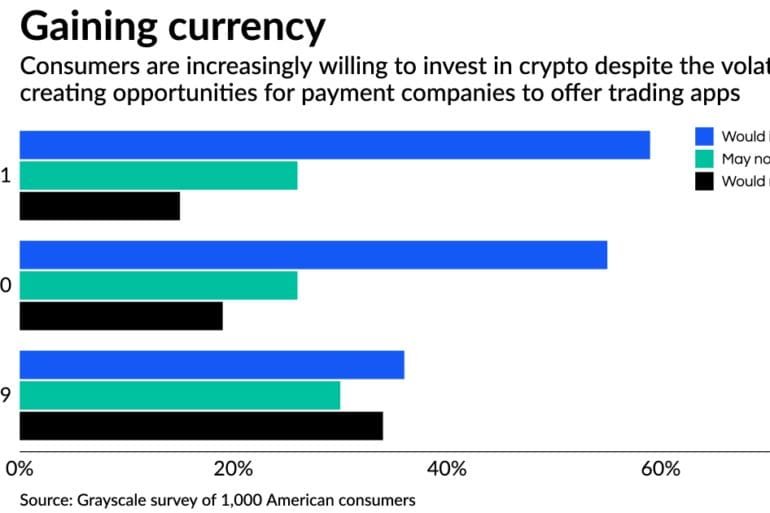

The U.K. fintech sees itself as a competitor to Block and PayPal's Bitcoin-trading operations, with plans to offer Americans banking services such as a savings account in the near future.

Crypto enthusiasts don’t only dream of revolutionizing the world of money. They want to reinvent the World Wide Web. That vision, which goes by the name of “Web3,” is of a decentralized environment built on crypto technology in which swarms of collaborators take back control of the web from giant tech companies. It’s a threat that those tech firms -- including Facebook owner Meta Platforms Inc. and Twitter Inc. -- are starting to take seriously.

The Vision Fund is a $100 billion investment portfolio and recently participated in a $440 million round in the challenger...

Financial reform is an uncertain topic for the fintech industry; Digiday talked with attendees at LendIt USA about their thoughts on the Trump administration's proposed regulatory reform; generally, participants reported that they believe the reform could increase interest from banks in partnering with fintech companies since deregulation gives them more flexibility for credit product expansion. Source

The fraud landscape is constantly changing and evolving with things like synthetic fraud increasing the costs consumers, businesses and governments are paying; synthetic identities are identities which are not tied to a real person; according to Pat Phelan from TransUnion, fraudulent transactions are currently costing the US $50 billion per year; Phelan talks with PYMNTS.com about some of the factors companies should consider when managing fraud and how businesses are managing fraud prevention programs overall. Source

Crowdfund Insider compiles a list of responses from fintech firms and how they are handling the current crisis; while fintechs...

The round was led by Grupo Coppel with participation from FirstMark Capital, Revolution Ventures and Colchis Capital; INSIKT has facilitated 125,000 loans over the course of three years; their white-label product provides an alternative to payday loans and is currently used by 600 banks and credit unions; funds will be used to expand to new states and internationally. Source