Episode 255 features Vishal Garg, the CEO and Founder of Better.com; he discusses the state of the mortgage market with...

The CEO and Founder of Better Mortgage tells us how his company is revolutionizing the home buying process. Source

The CEO of Citi Fintech shares how a big global bank is reinventing not just itself but banking as a...

Zor Gorelov is the CEO and Co-Founder of Kasisto; in our latest podcast he talks about conversational AI and how...

Online mortgage lender Lenda has plans to make the mortgage process last 30 minutes from start to finish; right now the company takes about 2 weeks to complete the process and has made more than $200mn worth or mortgages to date; Jason van den Brand, its co-founder and CEO, tells American Banker, "The big banks are working on technology that was built in the '70s. We cater to the customer who lives on their phone, laptop and tablet and shops online and compares online."; the biggest impediment is the appraisal process as that is still human intensive; the company has also been testing digital signatures by connecting via video chat with a notary. Source.

A phenomenal increase on the £1bn price tag that Lendable reached in March 2021.

·

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.

The deal help to increase their efforts to bring credit scoring and ID verification to emerging markets; “We’re thrilled to join forces with Lenddo and create an undisputed, global category leader in alternative data for credit decisioning,” said Jared Miller, CEO of EFL to Bankless Times; they will work with banks, telcos, retailers, microfinance institutions and insurers to help bring credit to people with little or no credit history. Source.

Singapore software-as-a-service company Lenddo has announced a new data partnership with Experian to support financial inclusion in Indonesia and Vietnam; the partnership will provide data analytics technology for Experian's Consumer Financial Inclusion Indexing platform; through the combined services of Lenddo and Experian, underserved banking consumers will gain access to financial services including remittances, savings, credit and wealth management services. Source

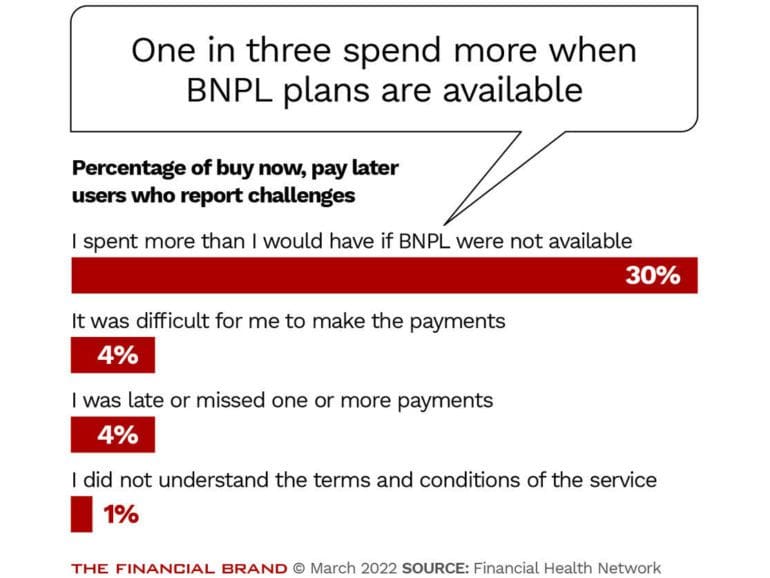

Consumers report strong credit performance but higher usage by financially vulnerable must be monitored closely as inflation and rates rise.