Colombian fintech Bold secured $50 million in a series C round led by private equity firm General Atlantic.

Looking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

Interest rates remain high, valuations have fallen and overall deal volume is down across sectors — including fintech M&A activity. But deals are still getting done, albeit slowly and with more caution from investors. BPM Partners James Lichau and Craig Hamm outline their top strategies for navigating the current fintech M&A environment.

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

We are syndicating a deep conversation across roboadvice, high tech and payments, and fintech bundling that we had with Craig Iskowitz of Ezra Group Consulting.

Check out Ezra Group Consulting here to learn more about digital wealth and Craig’s consulting practice. He is one of the sharpest software consultants in the RIA space, and his firm works with wealth management firms and fintech vendors to provide technology strategy and market research.

We had a lot of fun in this conversation and cover TD & Schwab, Wealthsimple, M1 Finance, Ant & Tencent, and Robinhood, among others. The full transcript is provided along with the recording — worth a read for the illustrations alone.

Robo 1.0 success Personal Capital was acquired for nearly $1 billion by Empower, a major retirement savings manager. Softbank-backed insurtech darling Lemonade IPOed at less than $2 billion, in a successful fundraise and listing, and has since seen its market cap rise to over $4 billion. The IPO is a landmark for an insurtech industry in desperate need of successes. And PayPal announces the impending launch of crypto trading to its 325 million users. The move isn’t overly interesting in its own right, but the implications for the crypto space are worth exploring.

In this conversation, we chat with Henry Yoshida – Co-Founder & Chief Executive Officer, Rocket Dollar. Prior to Rocket Dollar, Yoshida was the co-founder of Honest Dollar, a robo-advisor retirement platform that was acquired by Goldman Sachs, as well as a founder of MY Group LLC, a $2.5-billion assets under management investment firm. Henry shares his industry expertise as a speaker at several industry conferences, as well as having been featured or quoted in the Wall Street Journal, TechCrunch, Bloomberg Businessweek, and Financial Times. Henry has a passion for helping people be the best that they can be and contributes as a member in several financial and technology industry organizations. He graduated from The University of Texas at Austin and has an MBA from Cornell University.

More specifically, we touch on Henry’s career at BoA Merrill Lynch, his role at building a multi-billion dollar RIA business, how he started a digital retirement account platform called Honest Dollar which was sold to Goldman Sach’s neobank Marcus, the inception of Rocket Dollar, we talk IRAs and 401ks and how important these are for the current Gen-Z market, and so so much more!

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

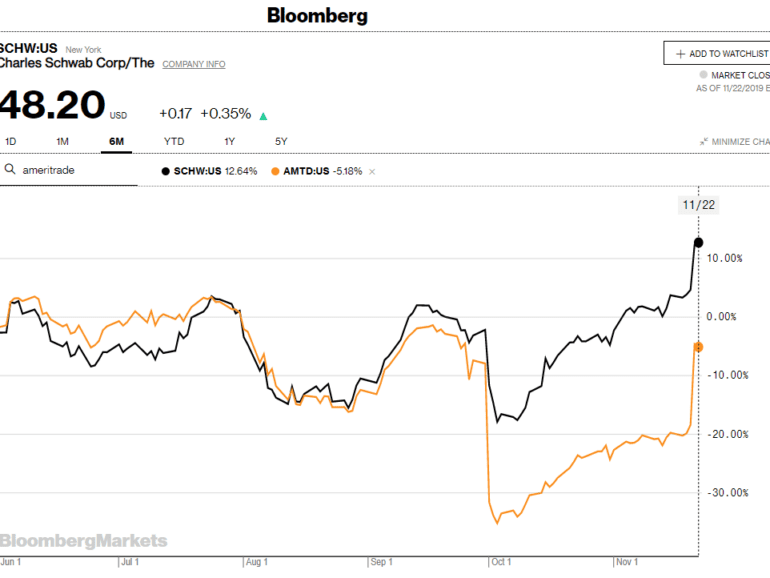

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

Research from TransUnion suggests that the Federal Housing Finance Agency’s (FHFA) move to a bi-merge system could significantly impact both consumers and lenders while providing little benefit.