This week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let's not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

In this conversation, we talk with Maximilian Rofagha, who serves as the CEO and Founder of Finimize, about how to do personal finance right and how to do it bottoms up for the world.

Additionally, we explore Max’s journey to becoming an entrepreneur, the nuances of the e-commerce business, the building of and drivers behind community and creating business activities around it, the influences of FinTok and crypto assets on financial community, and the drivers of value back into said communities fulfilling the feedback loop.

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

In this conversation, we talk with Paul Rowady, who is the Director of Research for Alphacution Research Conservatory. Paul has a deep background in capital markets, derivatives, and the macro structure of the industry. He has been uncovering the transformation of that structure with data driven analyses, making visible the economics of market makers like Citadel and retail order flow aggregators like Robinhood. This is a rich discussion of what trading stocks is really like. And make sure to check out Alphacution.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

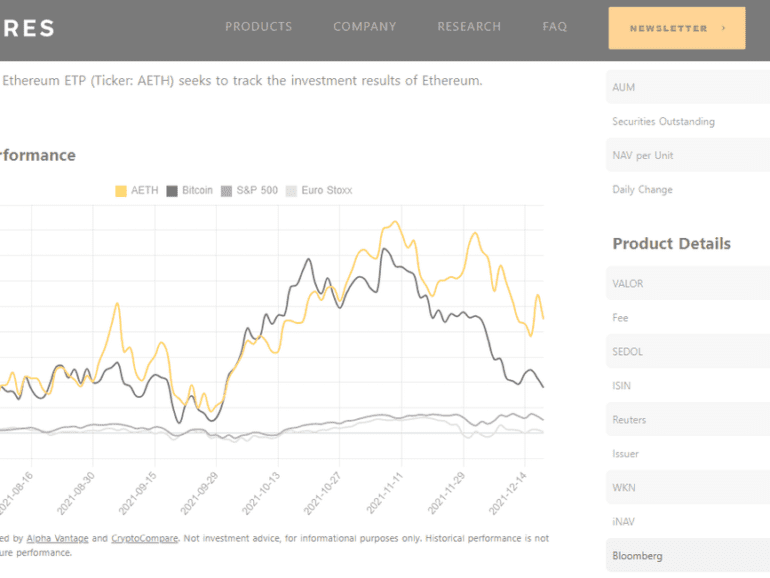

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

Mexican fintech Kapital raised $40 million in a series-B funding this month and $125 million in debt financing to expand to new markets.

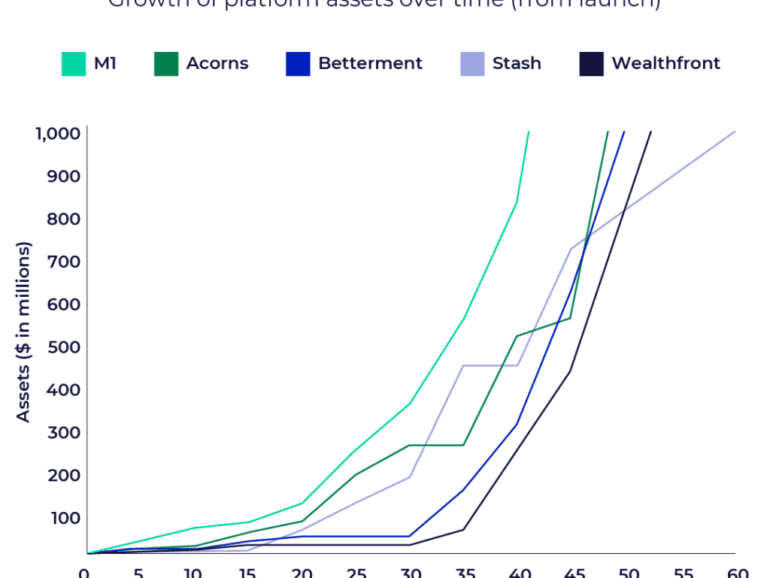

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.