Mexican fintech Kapital raised $40 million in a series-B funding this month and $125 million in debt financing to expand to new markets.

In this conversation, we talk with Maximilian Rofagha, who serves as the CEO and Founder of Finimize, about how to do personal finance right and how to do it bottoms up for the world.

Additionally, we explore Max’s journey to becoming an entrepreneur, the nuances of the e-commerce business, the building of and drivers behind community and creating business activities around it, the influences of FinTok and crypto assets on financial community, and the drivers of value back into said communities fulfilling the feedback loop.

Salt Labs, which helps lower-income workers but does not subtract from their earnings, has recruited Ted Benna, the father of the 401(k), as an advisor.

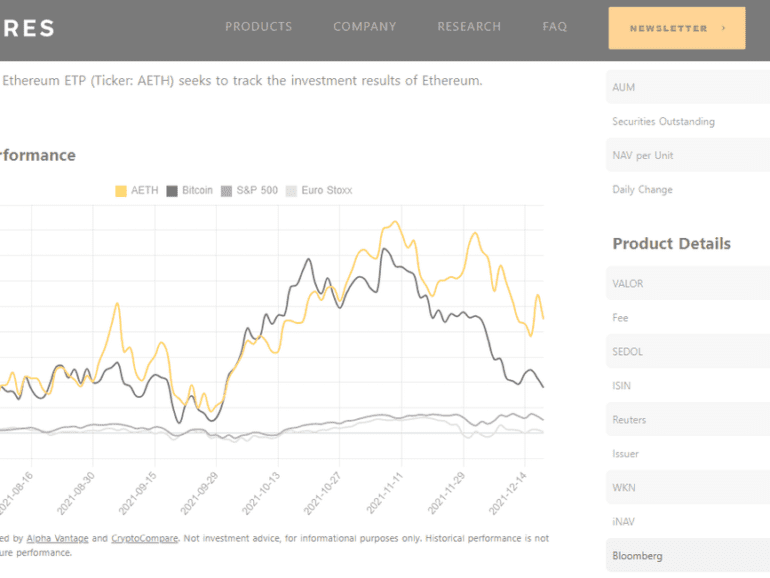

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

In this conversation, we chat with Jason Wenk, who is the Founder & CEO at Altruist. Apart from this Jason is a writer, self-proclaimed math geek, and investment systems developer. He began his career at Morgan Stanley in NYC at age 20, working on investment research and asset management systems development. After this Jason founded FormulaFolios: quantitative, computer-driven investment models based on academic research to help remove emotion from investing. FormulaFolios would later develop into a standalone asset manager and go on to rank as a fastest-growing private company by Inc. magazine 4 years in a row, reaching as high as #10 in 2017.

More specifically, we discuss all things wealth tech, as well as, serving people with financial planning, financial advice, and generally improving their financial health.

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

Colombian fintech Bold secured $50 million in a series C round led by private equity firm General Atlantic.

F-Prime released their latest State of Fintech report and it shows an industry back on the upswing but with still a lot of work to do.

E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

Research from TransUnion suggests that the Federal Housing Finance Agency’s (FHFA) move to a bi-merge system could significantly impact both consumers and lenders while providing little benefit.