Affirm‘s earnings call on Feb. 8, 2023, was followed by a sharp drop in confidence after founder and CEO Max Levchin announced that the company’s results had fallen short of the target.

This has caused the company to cut 19% of its workforce and shut down business areas, including its crypto initiative.

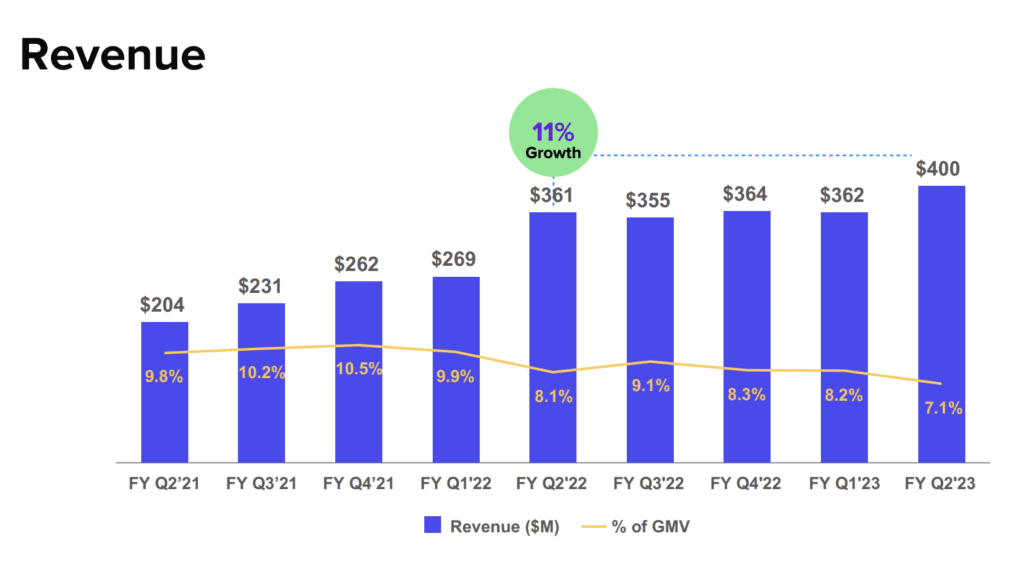

Revenue remained relatively flat, growing at 11% to $400 million over the last year. Gross Merchandise Volume (GMV) grew by 27%, with average order value dropping. Revenue Less Transaction Costs (RLTC) decreased by 21% over the year, 2.5% of GMV.

Delinquencies excluding the Pay in four loans had seen a drop towards the end of the last quarter, following a steady increase throughout 2022 to almost 3%.

Their adjusted operating income was still at a loss, dropping from $19 million to $62 million in the last quarter.

Strong measures taken

Analysts were concerned that the workforce reduction would affect the business’s long-term profitability and questioned whether the company would be leaning toward more automation in the future.

Like many in the fintech space experiencing job cuts, the company has taken the stance that it had overhired for the current environment. Levchin highlighted that the reduction in the workforce was a direct reaction to the slower-than-expected revenue growth.

“It is an economic reality that we have to live within our means and match the growth of headcount with the growth of revenue,” he said. “But for the record, we’ve rolled back six months of engineering hiring.”

He explained the company continued to focus on building new products with a streamlined workforce.

“We’ve shifted our geographic hiring focus to Poland, where we’ve been able to attract exceptional talent at a significantly lower cost than Silicon Valley, for example.”

A ‘key operational misstep’

Levchin attributed the inability to achieve their target partly to their delay in increasing prices for merchants and customers.

“A key operational misstep contributing to these results is that we began increasing prices for our merchants and consumers later in the year than we should have. This process has taken us longer than we anticipated. This had a negative impact on both our ability to approve more consumers and improve our margin.”

He explained that changing fees had taken much longer than the company thought and therefore had not yet been reflected in the results.

Looking forward

The guidance for the next quarter was shifted to a conservative range. RLTC was brought to between $140-$150 million, indicating the company didn’t see much short-term improvement from the recent drop to $144 million.

The other area of focus on the call, GMV, had guidance between $4.40-4.50 billion for the next quarter, which Levchin explained was realistic given the time of year.

It was noted, however, that the company expected both areas to decline significantly this quarter, in line with the trend seen in Q1 2022.

In addition, a significant restructuring following the reduction in workforce is expected to take place, driving $77 million to $83 million in additional costs. The company wrote that these charges would be excluded from financial results presented non-GAAP.

Going into the new year, Affirm stated that their next near-term milestone is achieving profitability on an adjusted operating income basis. While the trend has been a downturn further into loss over the past three quarters, Levchin outlined the three areas of focus in the future to achieve this goal.

- Accelerating GMV growth while optimizing RLTC – The company plans to roll out initiatives to help merchants capture more demand. They have said while these effects are initially subtle, they can compound to have a dramatic impact.

- Engaging consumers to drive greater frequency and repeat usage – Indications of how they would do this are somewhat vague, stating the post-transactional experience will be personalized. However, Affirm has seen trends of growth in consumer base, transaction size, and amount of repeat users over the past year.

- Growing profitable Affirm usage offline – Affirm’s Debit+ product was initially introduced to existing customers to take advantage of the 80% of offline commerce. While initially unprofitable, the company said they have worked on fine-tuning the economics and will introduce the feature as part of the app to encourage usage.

Although profitability is the ultimate goal, Levchin highlighted that managing credit remains of utmost priority.

“We will manage credit, most importantly, job number zero,” he said. We will never allow growth to trump the necessity of managing losses and yields.”

“But there’s absolutely no reason to believe that, having taken over a quarter of US retail sales, we’re gonna attenuate and match some ‘steady as she goes’ growth rate.”

RELATED: Fintech Ticker Table