The Chief Risk Officer at Pipe provides new perspective on the collaboration between risk and product teams in fintech

·

The Bank of Missouri has partnered with Corserv to enable the issuing of Visa credit cards for their customers.

As scrutiny of Buy Now Pay Later increases, so too do satisfaction scores among customers using the short-term financing mechanism structured like an installment loan.

A New York Fed report shows Americans leaned heavily on their credit cards in June to offset growing financial pressures from inflation.

Affirm's earnings were fantastic. This continued the trend of publicly traded fintech companies breaking records for revenue and profitability.

Hispanics are an emerging American economic force, and Tricolor founder and CEO Daniel Chu has a plan to serve them.

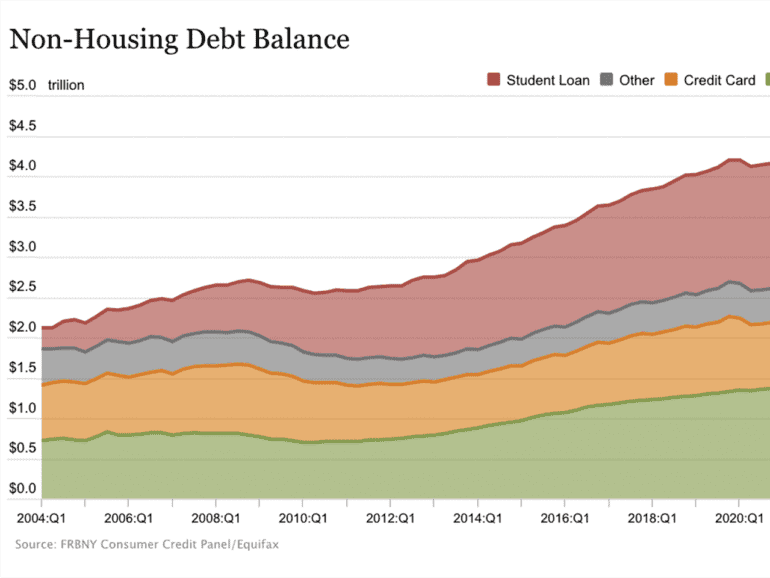

The resumption of private student loan repayments provides an opportunity for financial institutions to provide better tools to help with debt management.

The Biden Administration's recent decision to end the Small Business Administration’s (SBA) decades-log moratorium on licensing new lenders opens the doors for community banks and credit unions to meet the needs of underserved communities, industry representatives believe.

John Tomich, CEO of Credit Key, said he sees evidence of credit washing and wants to bring awareness to the recent trend.

During challenging economic times it is important for lenders to use new technology to help find new markets