CreditEase Wealth Management announced the first close of their second fund dedicated to investing in Israeli tech startups; the amount raised was $32.2 million; final target for the fund is $50 million; the focus of investments will include virtual and augmented reality, artificial intelligence and machine learning, digital healthcare, internet of things technology, cloud and data storage, and advanced manufacturing. Source

News Roundup

This page contains an archive of the Global Newsletter summaries and the weekly fintech news roundups.

Every day the Fintech Nexus news team scours the globe for the most important stories of the day to include in our daily newsletter.

Then every Saturday we bring you our weekly news roundup of the top 10 fintech stories of the week with commentary from Peter Renton.

To join our newsletter community please subscribe here.

Northwestern Mutual has formed Northwestern Mutual Future Ventures which will invest in fintech firms; according to the press release, the commitment will focus on innovation to build greater digital relevance for clients, increase data-driven decision making and create back-end efficiencies with the goal of creating value for its more than four million clients; investments will range from $500,000 to $3 million; the company has already seen benefits from the acquisition of LearnVest in 2015 and is looking to invest more in similar companies. Source

Biz2Credit has released its monthly Biz2Credit Small Business Lending Index report which provides approval rates on small business loans; large lenders increased approval rates while alternative and credit union lenders reported decreases; big banks reported an approval rate of 23.9% in December, an increase of 0.02% from November and 1% from December 2015; the small bank approval rate increased to 48.9% and the institutional lenders approval rate increased to 63.4%; alternative lending approval rates decreased to 58.6% and the approval rate from credit unions decreased to 40.9%. Source

PeerIQ released its fourth quarter "Marketplace Lending Securitization Tracker" this week; marketplace lending accounted for $2.4 billion of the securitization market in the fourth quarter; data from the fourth quarter report shows securitization investments as an increasingly important source of capital for marketplace lending platforms; in 2016 70% of loans were invested in through securitizations. Source

FundersClub is an online venture capital firm investing in startups; it has invested in 217 companies in the past four years with 19 exits; the firm has announced a commitment to disclose quarterly public reports providing more transparency in a historically un-transparent industry; the firm's investments have been successful over the past four years with a comprehensive multiple for returns on realized exits of 1.1. Source

This week Digit announced it was launching a savings bot which will operate on Facebook's messenger; to date users have saved over $350 million with the app which tracks income and spending and subsequently transfers small amounts of money to a savings; the company is also rolling out a financial goal program using artificial intelligence which will allow users to set savings goals and timelines. Source

Marketplace lending platform Flender has reached its investment goal on Seedrs; firm has received investment of 500,000 British pounds ($608,680); the firm's crowdfunding campaign will close on January 17 and it plans to launch in the first quarter of 2017; the platform will provide innovative business credit services that facilitate lending through a borrower's social network. Source

Italian invoice trading platform Workinvoice has packaged 5 million euros ($5.31 million) worth of receivables financed through its platform in a securitization vehicle; the receivables portfolio was purchased by Italian portfolio manager Factor@Work; the securitization deal represents a new source of capital interest for the invoice receivables market. Source

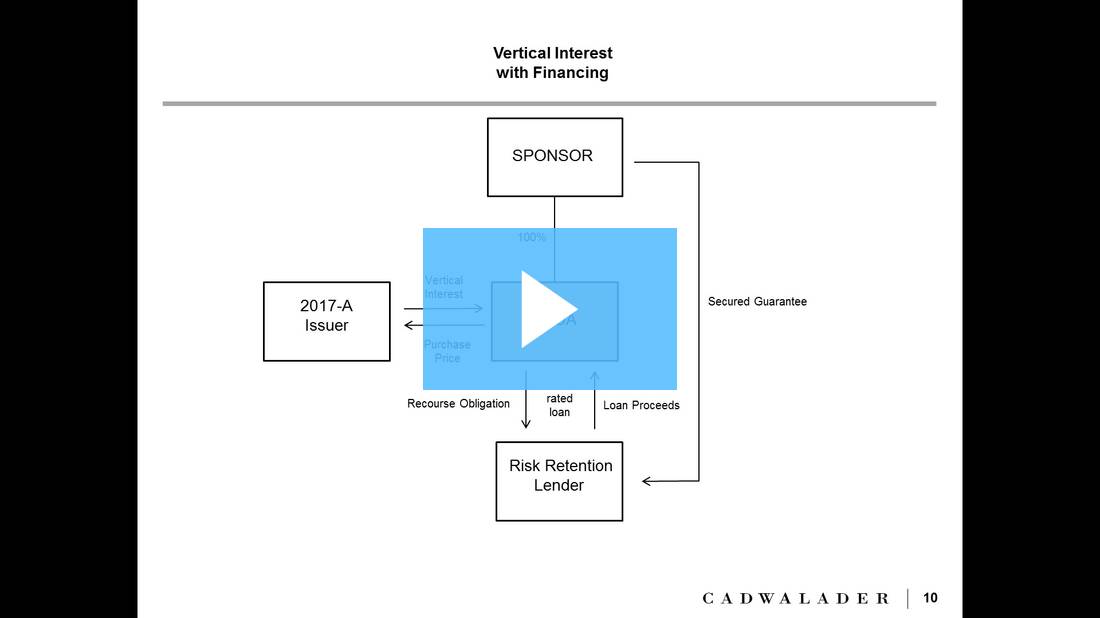

A replay is now available for LendIt's Key Considerations for Risk Retention in Securitization forum which was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers talked about a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned affiliates.

Artificial intelligence startup Kasisto raised a $9.2 million Series A round that was led by Propel Venture Partners; the company intends to use the funds to expand into new markets, grow the engineering and sales teams and develop partnerships with systems integrators to enhance their platform; Kasisto is a fintech startup that lets companies engage and transact with their customers through natural, intelligent conversations via smart bots and virtual assistants. Source