ClearBank has received its license for digital banking services in the UK; firm is run by Nick Ogden who also has payment services experience with WorldPay and CashFlows; the UK currently leads the challenger bank market with approximately 42 digital only banks. Source

News Roundup

This page contains an archive of the Global Newsletter summaries and the weekly fintech news roundups.

Every day the Fintech Nexus news team scours the globe for the most important stories of the day to include in our daily newsletter.

Then every Saturday we bring you our weekly news roundup of the top 10 fintech stories of the week with commentary from Peter Renton.

To join our newsletter community please subscribe here.

Funding Circle has announced a new equity investment of $100 million; the funding round was led by Accel and included existing investors Baillie Gifford, DST Global, Index Ventures, Ribbit Capital, Rocket Internet, Sands Capital Ventures, Temasek and Union Square Ventures; the funding brings the firm's total capital raised to $373 million and makes it the largest and best capitalized SME lending platform in the world. Source

State legislators have voiced opposition to the Office of the Comptroller of the Currency's (OCC) proposed fintech charter; primarily concerned with nationalized rules that would ease regulations currently in place by state governments and allow payday lenders to evade state rules established for consumer protection; senators have also opposed the national charters suggesting that federal regulators collaborate with state regulators; the OCC's comment period for the proposed fintech charter is open until January 15. Source

dv01 and Experian have announced a data partnership that will increase transparency for institutional investors; the collaboration will bring new data to dv01's platform allowing for broader risk analysis of marketplace loans and bonds; dv01's clients include leading hedge funds, banks and asset managers; the data enhancement will specifically provide for better analysis of origination trends, loan performance and borrower attributes. Source

iZettle has raised 60 million euros ($63.46 million) in a Series D funding round and hired a new chief financial officer; the firm is now valued at more than $500 million; says an initial public offering is one scenario it is considering for its next growth phase; the payment processing firm is comparable to US-based Square, offering card readers and credit financing for merchants; iZettle is based in Sweden and provides its service in 12 markets with market transactions led by the UK. Source

"Bitcoin, a New Asset Class" has been published by authors Chris Burniske and Adam White; in their research they identify bitcoin as an emerging asset class analyzing its characteristics over time; they find that its volatility has been decreasing while its price has been increasing; the authors make the case for including bitcoin as an investment in modern portfolio theory calculations; they expect the cryptocurrency to gain increased institutional investment and imply that including it in a modern portfolio theory managed account could help investors more efficiently manage the investment risk according to their risk tolerance. Source

Chinese regulators are considering custodian requirements for bitcoin to help mitigate effects from its market risks; the custodian support appears to be welcomed by platforms and investors in China; overall, Chinese regulators are taking a more active role in bitcoin market activity as Chinese investors increasingly account for a majority of bitcoin's trading volume. Source

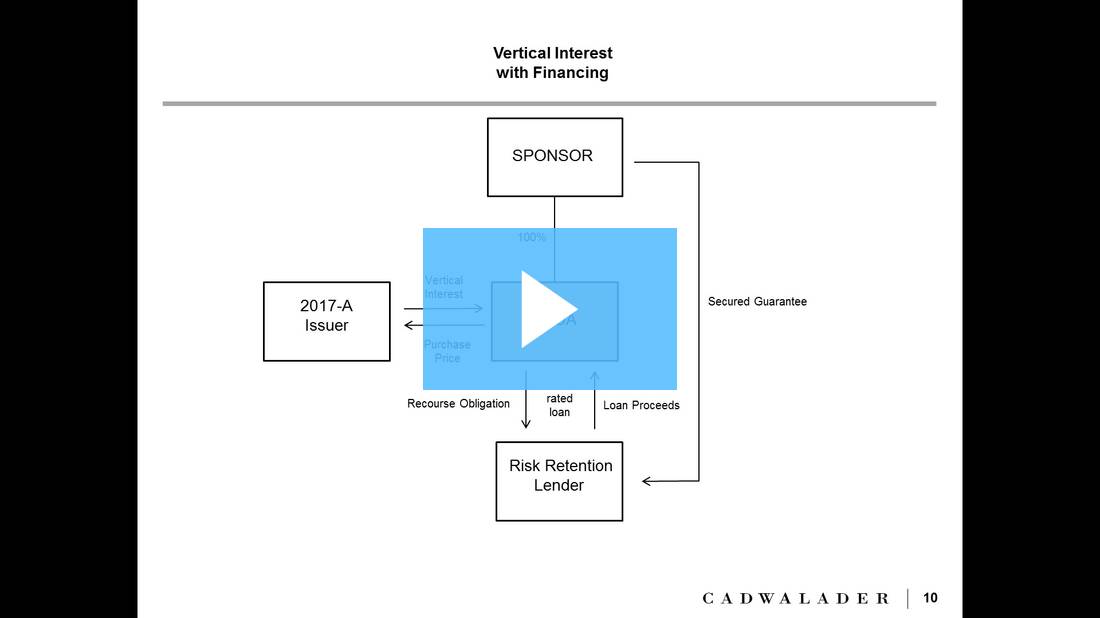

LendIt's most recent forum, Key Considerations for Risk Retention in Securitization, was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers provided insight on a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned-affiliates; a replay of the webinar is now available.

The Association of Alternative Business Finance is rumored to be the alternative lending sector's next representative association; the consortium has reportedly been developed by seven balance sheet lenders to represent the interests of their lending group; the association will seek to employ and enhance transparency, responsibility, fairness and security; its criteria for inclusion is primarily focused on business product lending. Source

Predictions in 2015 estimated that within 20 years half of the jobs in Japan could be done by robots; the Nomura Research Institute worked with Michael Osborne in 2015 to study 600 jobs in Japan reporting that 49% could be replaced by computer systems; since the 2015 predictions there has been a continued trend toward artificial intelligence with Japanese insurance company Fukoku Mutual Life Insurance releasing one of the first public announcements on artificial intelligence replacing a significant portion of workers in its payment processing department in January 2017. Source