Securitization has become increasingly utilized by marketplace lending platforms and in 2016 a record number of deals were done; Lend Academy provides details on securitization structuring, Lending Club's recent securitization and the importance of transparency in their article; in Lending Club's December securitization the total amount of loans in the portfolio was approximately $131.3 million and the portfolio was rated by Kroll Bond Rating Agency. Source

News Roundup

This page contains an archive of the Global Newsletter summaries and the weekly fintech news roundups.

Every day the Fintech Nexus news team scours the globe for the most important stories of the day to include in our daily newsletter.

Then every Saturday we bring you our weekly news roundup of the top 10 fintech stories of the week with commentary from Peter Renton.

To join our newsletter community please subscribe here.

Sichuan Xinwang Bank and Jilin Yilian Bank have received licensing to provide internet banking services in China; the two banks will bring the total number of digital only banks in China to four; Xiaomi is a leading Chinese shareholder in Sichuan Bank with a 29.5% stake and Meituan is a leading shareholder in Jilin Yilian Bank with a 28.5% stake; the other two digital banks in the Chinese market include Ant Financial's MyBank and Tencent's WeBank. Source

CompareEuropeGroup is a London fintech company using artificial intelligence to develop digital and automated services for financial companies; it has obtained 20 million euros ($21.32 million) in new capital from a Series A funding round; investors included ACE & Company, Pacific Century Group, Nova Founders Capital, SBI Holdings, Mark Pincus and Peter Thiel; the company will use the funds to develop its technology and machine learning services. Source

Canadian robo advisor WealthBar now manages over CAD$100 million (USD$75.93 million) in assets under management; the firm was launched in 2014; it currently offers online onboarding, investment management, financial planning and an individual advisor; its services have also expanded to private investment portfolios and registered retirement savings plans. Source

A new report by Accenture shows that seven out of 10 consumers would welcome exclusive robo-generated advice for investing and insurance needs; not all is lost for the human experience; 68% of consumers would still want to interact with a human for complex financial needs like a mortgage or to help solve a problem; the main reasons given for this shift are computers are seen to be less biased, they make services cheaper and the tasks are done faster; additionally, the report showed that consumers were willing to share their data if they thought a non traditional provider could be faster and cheaper. Source

Artificial intelligence is maturing and has gained significant traction in some of the market's leading industries; Finovate provides eight areas where artificial intelligence is being utilized and gives predictions on its potential value; top industry services using artificial intelligence include robo advisory, advisory tools, fraud detection and underwriting; services with significant value potential in 2017 include regulatory compliance, marketing, customer service and reporting tools. Source

Predictions in 2015 estimated that within 20 years half of the jobs in Japan could be done by robots; the Nomura Research Institute worked with Michael Osborne in 2015 to study 600 jobs in Japan reporting that 49% could be replaced by computer systems; since the 2015 predictions there has been a continued trend toward artificial intelligence with Japanese insurance company Fukoku Mutual Life Insurance releasing one of the first public announcements on artificial intelligence replacing a significant portion of workers in its payment processing department in January 2017. Source

The Association of Alternative Business Finance is rumored to be the alternative lending sector's next representative association; the consortium has reportedly been developed by seven balance sheet lenders to represent the interests of their lending group; the association will seek to employ and enhance transparency, responsibility, fairness and security; its criteria for inclusion is primarily focused on business product lending. Source

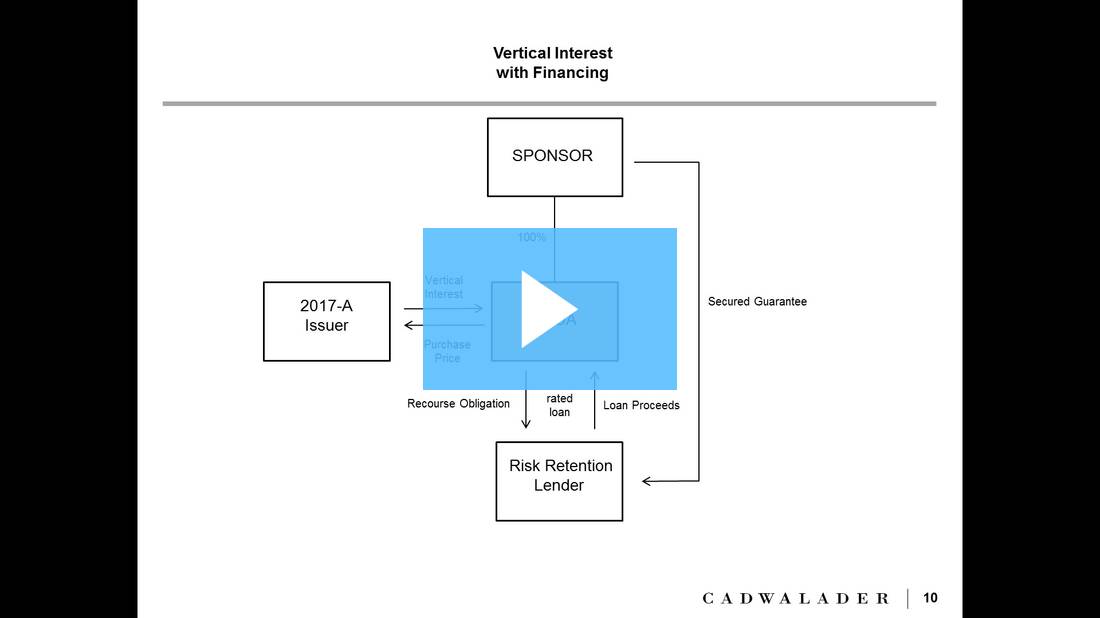

LendIt's most recent forum, Key Considerations for Risk Retention in Securitization, was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers provided insight on a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned-affiliates; a replay of the webinar is now available.

Chinese regulators are considering custodian requirements for bitcoin to help mitigate effects from its market risks; the custodian support appears to be welcomed by platforms and investors in China; overall, Chinese regulators are taking a more active role in bitcoin market activity as Chinese investors increasingly account for a majority of bitcoin's trading volume. Source