No doubt, when Binance CEO CZ took to Twitter in the early moments of the FTX failure last year, he...

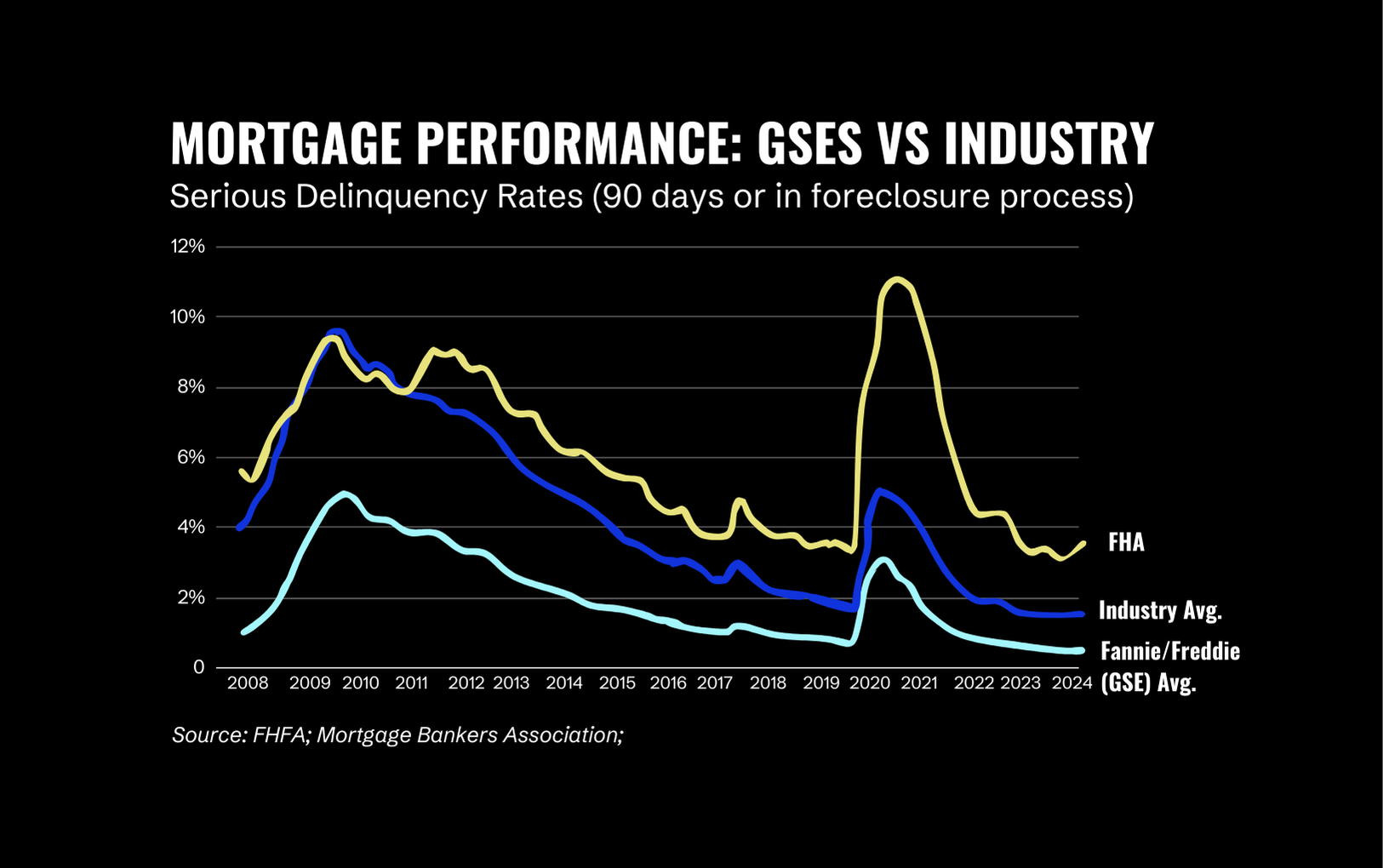

The Trump Administration has telegraphed significant changes to GSE mortgage lenders — with massive implications for the industry Since his...

BaaS fintech Synapse is having a rough year. Synapse and its clients need to be removed from Evolve's platform by December 31.

These funds should allow Blipay to expand its credit line in the payroll anticipation sector — where it seeks to become a relevant player.

Anchor cofounder and CEO Rom Lakritz has long been troubled by billing inefficiencies. Now that technology exists to solve it, he’s the perfect man for the job.

E-commerce is quickly catching up in Latin America, providing fertile ground for digital payments to proliferate.

On March 29, the Boston-based anti-fraud firm FiVerity announced a "holistic" fraud analytics platform to help firms stop criminal activity.

Payable announced a new $6-million seed round on Tuesday.

Amdist valuation troubles and a looming tax bill, Stripe raises $6.5 billion in Series I funding round, beating skepticism.

·

While VC funding is scarce, Arc is building on its alternative funding options, focused on early-stage startups looking to grow.