Those of us who have been around the online lending space for a while will remember the “Lendscape” created by Orchard Platform (now part of Kabbage). It was a very useful infographic featuring all the major players in the online lending ecosystem. I used to refer to it on a regular basis whenever I wanted a complete picture of a segment of our ecosystem. It was last published in 2017 and I have missed having access to an up to date resource like this. We had even talked about internally at LendIt Fintech about recreating something like it. Now, we don’t have to.

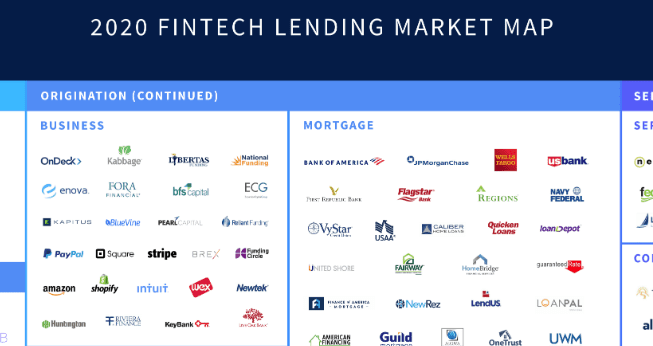

Earlier this month Ocrolus released the 2020 Fintech Lending Market Map. While it is not an exact replica of the Orchard Lendscape it is a super useful resource. The big difference is that they ignore the investor side of the online lending space and bring in more of the technology and infrastructure companies. This makes sense given that Ocrolus is a technology company building the infrastructure to analyze documents and automate back office tasks and is used by many of the leading online lenders.

I caught up with David Snitkof, former co-founder at Orchard and now the Head of Analytics at Ocrolus, a position he has held since April. What was interesting to me is that this new market map of the fintech lending ecosystem was not actually his idea. He said there were many people at Ocrolus who were also big fans of the old Lendscape and were keen to resurrect it. Obviously, David would have been a great resource for Ocrolus and he did in fact have significant say in to how it was was produced.

When looking at the full infographic I am struck by how far our industry has come in the last decade. While we have certainly had our challenges, the innovations that were pioneered by a select group of companies a decade or more ago have led to loans now becoming a standard online offering. You will see several of the largest banks in the country on this infographic as they have integrated online lending into their business.

Now, not every company is listed and some companies maybe should not have made it in. But overall, Ocrolus has done the industry a great service by creating the most complete market map of fintech lending in several years.