OnDeck has made many changes to the business over the last several quarters. With their latest financial results released today, the firm reiterated their plans to achieve GAAP profitability in the fourth quarter of 2017. OnDeck was affected by Hurricanes Harvey and Irma in the third quarter and would have posted numbers closer to breakeven if it wasn’t for these storms. Similar to other lenders in the space, OnDeck announced that they worked with borrowers on payment plans for those located in the disaster zones. By the end of October, most of their affected borrowers were back in business.

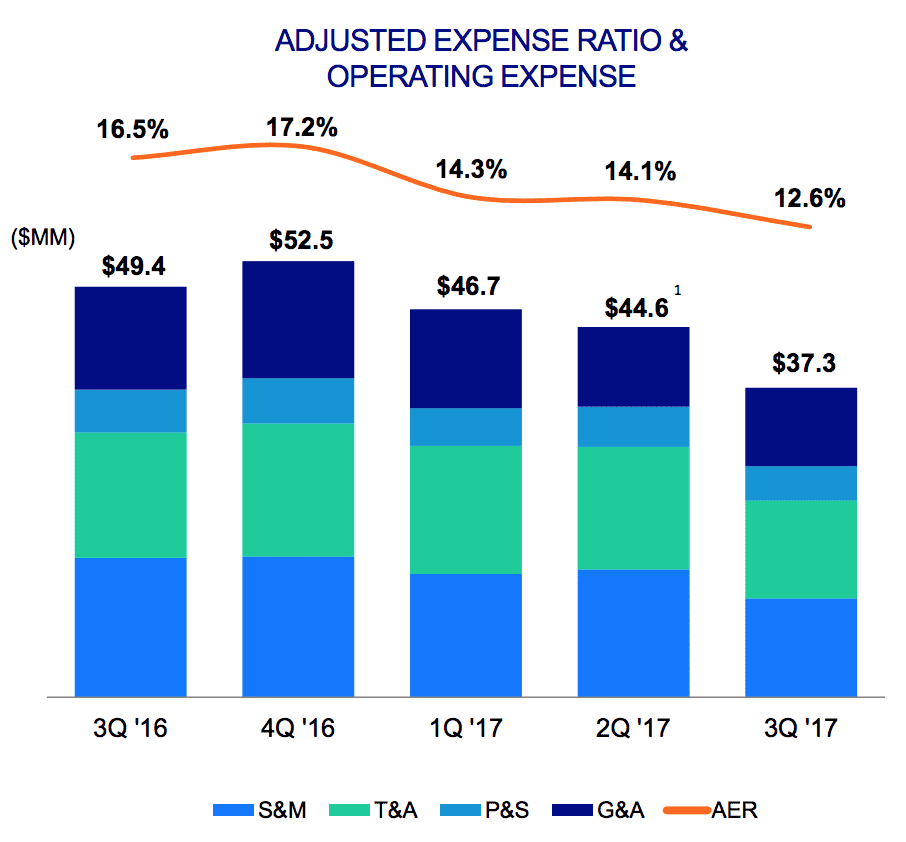

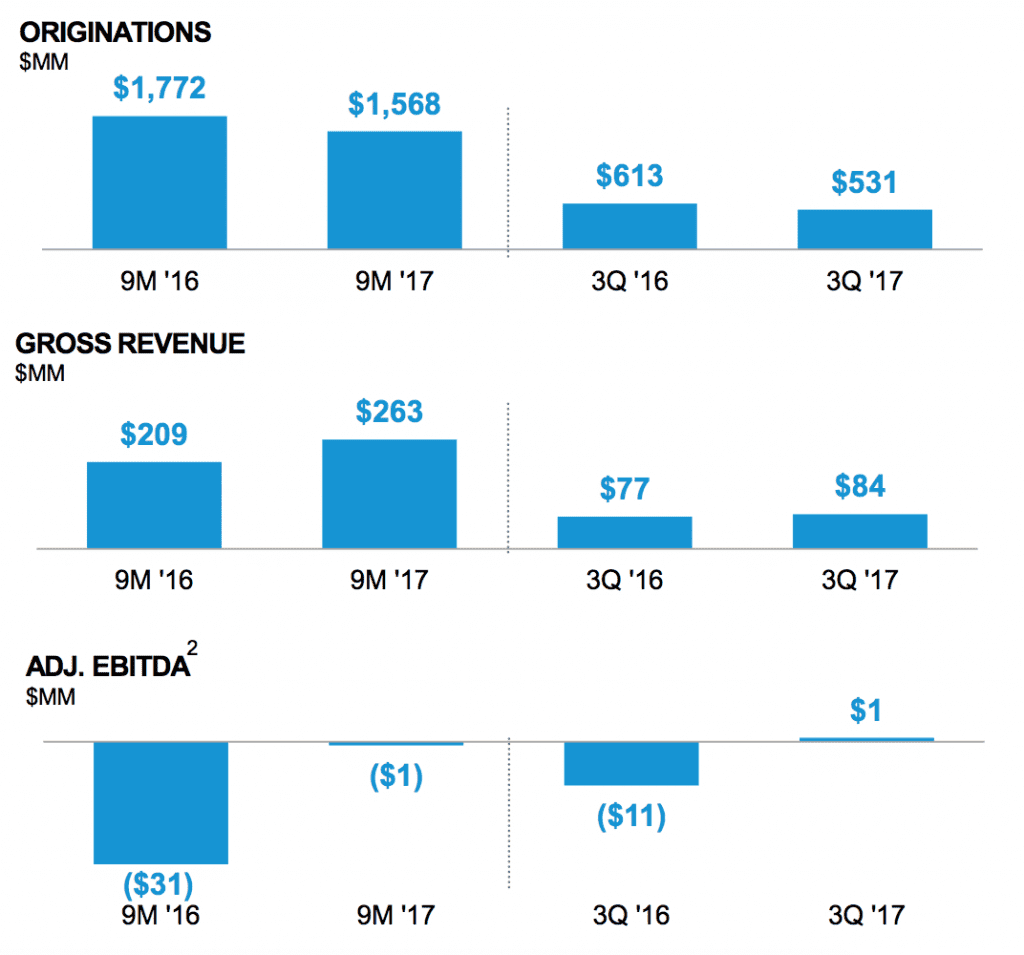

Originations in the quarter grew to $531 million, up 14% from the prior quarter. They also reported that operating expenses were at the lowest level in more than two years. According to the company, their credit quality of new borrowers remains near historic highs reflected in both the OnDeck Score and personal credit scores of borrowers.

Revenue increased to $83.7 million, up 8% over the prior year period. Not surprisingly, loans sold or designated for sale continued to fall and represented just 1.3% of term loan originations. Other Revenue increased $0.7 million from the previous quarter to $3.4 million which reflected increased revenue from OnDeck-as-a-Service. Compared to the third quarter of 2016, the company improved bottom line performance by $12 million.

In the third quarter OnDeck shared that their partnership with JP Morgan Chase was extended for up to four years. Two weeks ago they also announced a partnership with VISA and Ingo Money which disburses loan proceeds in real time to business debit cards. In the earnings call CEO Noah Breslow noted that they still believe they are in the early days of the potential of partnerships. The company teased another big bank partnership to be announced in the first half of 2018.

On the operational side of the business OnDeck reported that they were testing more features including asking for more information up front from borrowers and optimizing collections. Breslow discussed the decision to test litigating loans themselves where borrowers have failed to make payments. Previously, the company relied on third party debt buyers, but now has built out a team internally. They believe they will recover more in the long term than what they previously received with debt buyers.

Conclusion

Overall OnDeck reported a solid quarter with originations coming in higher than projections. They continued to execute on their plan and continue to meet the goals they set out for themselves. As pointed out above, OnDeck is just scratching the surface of what is possible with bank partnerships. The reality is that banks move slow and as Breslow noted in the Q&A, they are playing the long game here, looking out 5 to 10 years into the future since these deals take a long time to scale.