Wave and OnDeck have partnered to offer credit products to small businesses; Wave currently offers small businesses financial tools and software for managing their business; the firm will now offer its clients new credit products through Lending by Wave; with Lending by Wave clients can directly access loans and credit lines from OnDeck through the Wave ecosystem. Source

A WeBank employee wrote a post in WeChat Moment, announcing that the loan amount of Weilidai (WeBank's micro loan product) is over RMB100 billion ($14.92 billion); Weilidai's loan amount has increased almost 300% over the past seven months; according to its financial results, WeBank lost RMB583 million ($86.97 million) in the first year (2015); but in 2016, it made a profit of RMB401 million ($59.82 million); in the first four months of 2017, WeBank made a profit of RMB500 million ($74.59 million); in terms of product, WeBank has launched an enterprise-grade product, "Weiyedai"; Weiyedai provides unsecured loans of up to RMB3 million ($447,507) to enterprises, with annual percentage rates ranging from 10.95% to 16.43%. Source (Chinese)

A replay is now available for LendIt's Marketplace Lending 101 forum which was held on Wednesday, January 18; Peter Renton from LendIt and Andrew Dix from Crowdfund Insider took questions from participants about the marketplace lending industry and discussed how to effectively invest in marketplace loans. You can view the webinar replay here:

A replay is now available for LendIt's Marketplace Lending 101 forum which was held on Wednesday, January 18; Peter Renton from LendIt and Andrew Dix from Crowdfund Insider answered questions from participants about the marketplace lending industry and discussed how to effectively invest in marketplace loans; many of the topics discussed will be covered further at LendIt USA in March.

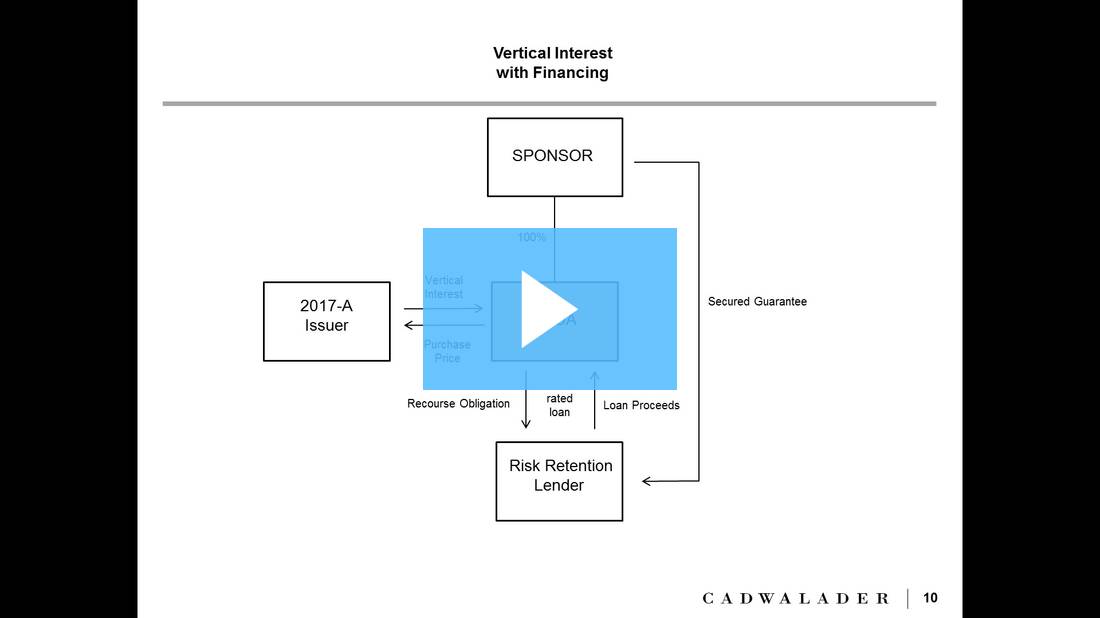

LendIt's most recent forum, Key Considerations for Risk Retention in Securitization, was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers provided insight on a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned-affiliates; a replay of the webinar is now available.

A replay is now available for LendIt's Key Considerations for Risk Retention in Securitization forum which was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers talked about a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned affiliates.

LendIt will be hosting a LendIt Forum today featuring speakers Peter Renton from LendIt and Andrew Dix from Crowdfund Insider; participants can submit questions for the speakers to learn more about the evolution of the industry and how to effectively invest in marketplace loans; the forum will take place at 2:00 PM EST; register here and join the webinar today. Source

LendIt will be hosting a webinar today at 2:00 PM EST; the Lendit Forum will feature Aaron Peck from Monroe Capital and Tim Ranney from Clarity Services; the speakers will discuss the profile of non-prime borrowers and where the best investments are in the non-prime space; other topics will include how alternative data can be used to better assess the borrower's risk, interest rates for non-prime borrowers and the types of return investors can get when making this investment; register here and join the webinar today. Source

LendIt will be hosting a forum today on risk retention in securitization at 2:00 PM EST; the forum will be held in conjunction with Cadwalader and Lending Times; speakers will provide insight on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements necessary to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and other related topics; register here and join the webinar today.

Securitization continues to be a key source of capital for many marketplace lenders; LendIt, in association with Cadwalader and Lending Times, will host a forum on Wednesday, January 11th at 2:00 PM EST; the webinar will focus on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and more; register today.