Crowdfund Insider talks with Ron Suber about Prosper and marketplace lending in 2016; in 2016 the firm reported decreased investment and transaction fee revenue which led to a number of new initiatives and changes; in his comments Ron Suber cited the importance of being adaptable to change; he also talked about the investment opportunity from institutional investors and the importance of securitization and a secondary market; for 2017 he expects rapid changes for the industry to continue and hopes that as the industry evolves it will result in more opportunities for borrowers, online lending platforms and the ecosystem. Source

eOriginal has added Ron Suber, Prosper Marketplace president, to its advisory board; the digital transaction document management company has been steadily expanding its business in the marketplace lending market; Ron Suber will help support the company's growth as an advocate for its unique digital documentation products also advising the company on the marketplace lending market overall; eOriginal is currently growing and expanding, also adding Jon Barlow, founder and former CEO of Eaglewood Capital Management, to its advisory board and raising $26.5 million in a recent funding round. Source

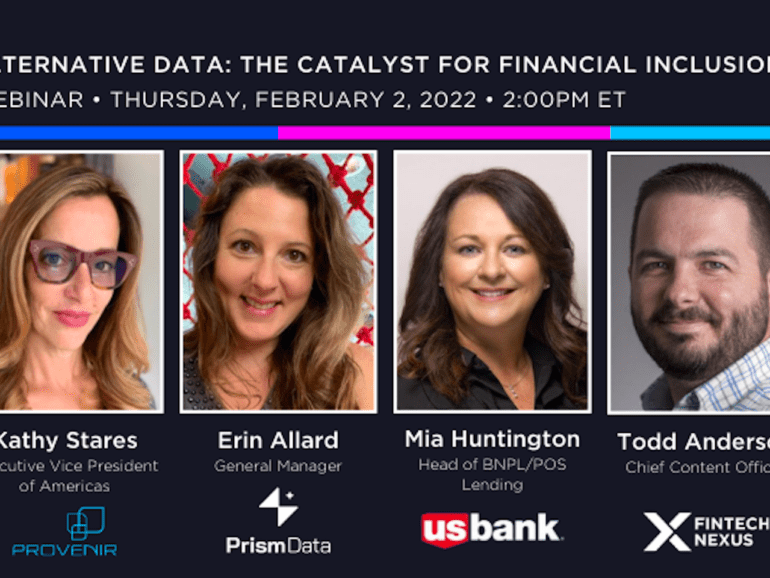

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.

Fintech Global provides the top ten deals for the quarter; financing from the top ten deals was $658 million and accounted for 84% of the sector's total financing; Chinese P2P lender Tuandaiwang was the quarter's financing leader obtaining $262.6 million and was the only Asian fintech company in the top ten; Europe reported the majority of top ten financings with five funding deals. Source

NSR Invest, which allows Lending Club and Prosper investors to analyze loan data and direct investments, has made Prosper's Q3 data available; users can now backtest the most recent Prosper loan data and view trends of older vintages yet to reach maturity; originations for Q3 2016 totaled $311 million. Source

The Department of Justice's case against Quicken Loans will be heard in Detroit; in an ongoing case filed in April 2015, the Department of Justice says Quicken Loans used faulty underwriting processes to certify Federal Housing Administration (FHA) loans while disregarding FHA rules; Quicken is a direct endorsement lender for the FHA and the loans in the court case were originated from September 2007 through December 2011. Source

Ram Ahluwalia and PeerIQ have become a significant part of the ecosystem for marketplace lending providing loan data analytics and securitization research; Ahluwalia recently talked with Crowdfund Insider about his perspective on the market; cited institutional support as a positively improving factor for lenders with securitization issuance increasing 60% in 2016; says loan originations in 2016 still reported substantial growth despite industry challenges and notes PeerIQ is working with industry participants to help develop new products for retail investors; Ahluwalia also discusses the industry's regulatory concerns and competition from banks as well as the global market outlook for the industry. Source

The Ranger Direct Lending Fund is trading at a discount to its NAV in part due to effects from issues at Argon Credit; the Fund had exposure of $28 million to Argon when it announced its bankruptcy in December 2016; while it said the Fund would see little effect from the exposure it has now announced a write-down from holdings in the Princeton Alternative Income fund which was affected by Argon Credit; further developments continue to occur and volatility is expected to continue for the Fund's share price. Source

The Ranger Direct Lending Fund announced its second quarter 2017 dividend; the Fund has decreased its dividend to 24.26 pence per ordinary share; the lower dividend was a result of ongoing issues with investment in the Princeton Alternative Income Fund which had exposure to troubled lending platform Argon Credit; the Fund's returns have also been lower over the past few months and it has increased its cash holdings. Source

The Ranger Direct Lending Fund has reported plans for share issuance totaling 200 million British pounds through 2017; the Fund currently has a 40 million British pound issuance planned for December; it also raised 30 million British pounds in July and 23.2 million British pounds in November of 2016; according to a statement from Ranger Direct Lending, "The company believes that debt instruments originated or issued by direct lending platforms are an attractive and growing asset class that have the potential to provide higher returns for investors than other, more widely available, fixed income products."; growth from the asset class and potential returns are factors driving the new issuances. Source