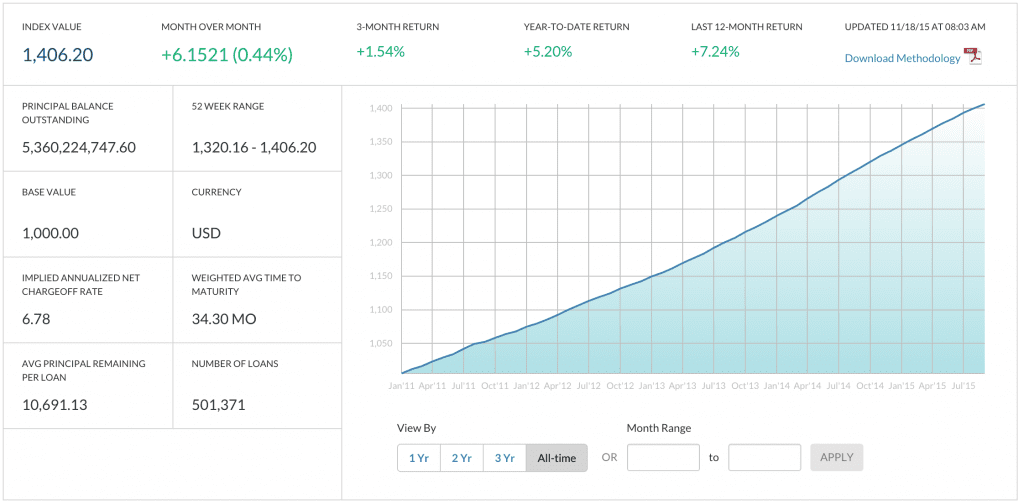

Today, Orchard announced that their Orchard US Consumer Marketplace Lending Index will be distributed on the Bloomberg Professional Service. The index measures the performance of consumer online lending and tracks the overall performance of the aggregate amount of loans originated through various platforms. The Orchard index is currently the only one available for the US market and data is available starting from 2011. The index is based on data from the two largest consumer marketplace lenders: Lending Club and Prosper.

Subscribers to Bloomberg will now have access to the marketplace lending index and will be able to download the data. Besides market performance the index includes other key indicators such as charge-offs and industry growth rates. Platforms that meet certain criteria are added to the index and several are slated to be added in the next 12 months.

Matt Burton, CEO of Orchard, stated:

Every asset class needs a benchmark, and we’ve created the first one for the marketplace lending industry. Much of marketplace lending’s success to date is due to the loan level transparency on each and every loan an investor is able to select. The Index takes that transparency to a new level by aggregating terabytes of information into a usable and easy-to-understand benchmark.

This is great news for the industry as having a marketplace lending index on Bloomberg Professional Service helps solidify marketplace lending as its own asset class. If you want to learn more about the methodology used and the criteria for inclusion, check out Orchard Indexes website.