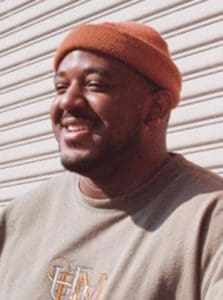

On episode 54 I talk with Michael Broughton of Altro. Altro helps you build credit and financial power through the recurring payments and subscriptions you use every day.

There are so many different facets and problems with someone’s credit profile. It is still amazing with the amount of data that exists today that a person still needs to go into debt to build a proper credit score and profile.

Michael and the team at Altro have begun to change that issue by bringing payments and subscriptions into the core credit profile, a trade line as it is called. Many other firms help bring some of this data as an additive to a profile, an alternative data boost.

Altro puts this data into your credit profile as if it were a loan or a credit card. This helps lenders and other financial firms begin to better assess your willingness to pay based on how you live. This type of innovation helps those outside the traditional credit spectrum the most.

Michael and I talk about how Altro was able to work with bureaus to create this trade line, where the credit score is today, financial health and inclusion, getting a stamp of approval and meeting Jay-Z, raising capital, and a whole lot more.

So without further ado, I present Michael Broughton of Altro. I hope you enjoy the show and be prepared to learn:

- Mike’s journey to Altro

- Mike’s personal story with credit

- The meaning of the word Altro

- The importance of adding this data as a tradeline

- The difference between alternative and trade line data

- How they worked with the credit bureaus

- Revamping the credit score

- The importance of education

- How much Jay-Z and Marcy Ventures meant to their story

- Recommended reading – The Invention of Hugo Cabret by Brian Selznick

- Recommended reading – Principles by Ray Dalio

- And much more…

Download a PDF transcription of No. 54 Michael Broughton