Over the last 24 hours we’ve received several messages from Lend Academy readers alerting us that they have received information that they are no longer able to invest in LendingClub notes. There is is also an active discussion on the Lend Academy forum. One member shared the email they received below.

Hi ****,

We wanted to let you know that new LendingClub Notes are temporarily unavailable in your state. We’re working diligently to address this matter and apologize for the inconvenience.

This won’t disrupt the servicing of your existing Notes, but it does mean that you won’t be able to purchase new Notes for the time being or access the LendingClub mobile app as its primary purpose is to purchase new LendingClub Notes. Consequently, you may notice cash accumulating in your account from principal and interest payments.

During this time, you may still participate in the secondary market. Learn more here.

We appreciate your patience, and as a small token of our gratitude for your business, we’d like to offer you an Amazon gift card.*

Thank you,

The LendingClub Team

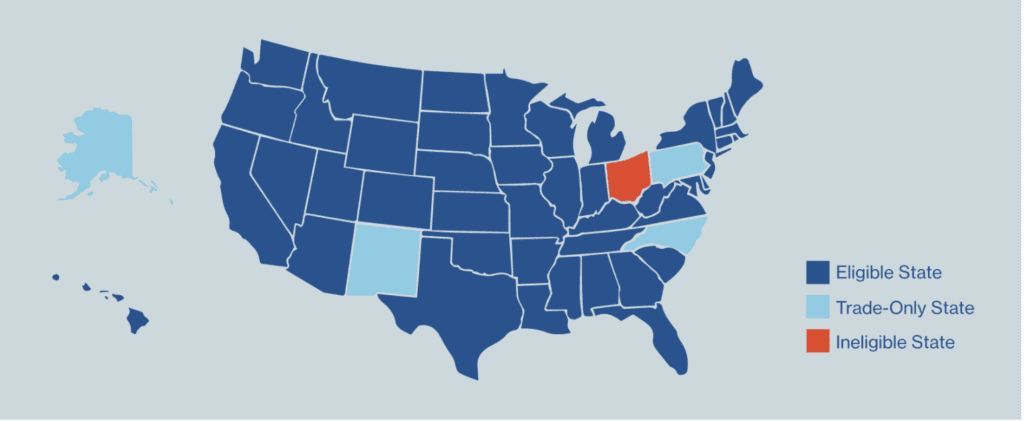

LendingClub has also updated their state eligibility map shown below. It’s clear that more states are now designated as trade-only states which limits investors to participating only on LendingClub’s secondary market.

In order to better understand which states were effected I was able to pull a cached version of the same map. New York, Florida, Texas and Arizona investors have all been affected by the change. Given that these are highly populous states it is likely that thousands of investors are impacted.

The disappointing part of this news is that LendingClub is not providing details on why this change was made or how long they expect the restrictions to last. We reached out to LendingClub last night for comment and received the following response:

We made the decision to temporarily stop offering new LendingClub Member Payment Dependent Notes (Notes) to investors in certain locations. Investors in all locations except Ohio can still buy Notes on the secondary market, just as they can in other trade-only states.

This action affects a very small amount of total investor funding. It does not affect existing Notes or servicing. As usual, investors may also continue to buy or sell previously issued Notes on the secondary trading platform.

Frustrated investors, many who have been investing for the long haul, have also reached out to LendingClub but have received no further information than what is posted above. While whatever happened behind the scenes at LendingClub only affects a small fraction of their overall investor base it is disappointing that LendingClub is not providing any transparency on the news. Investors deserve to have some clarity here. We will update this post if we receive any further information.