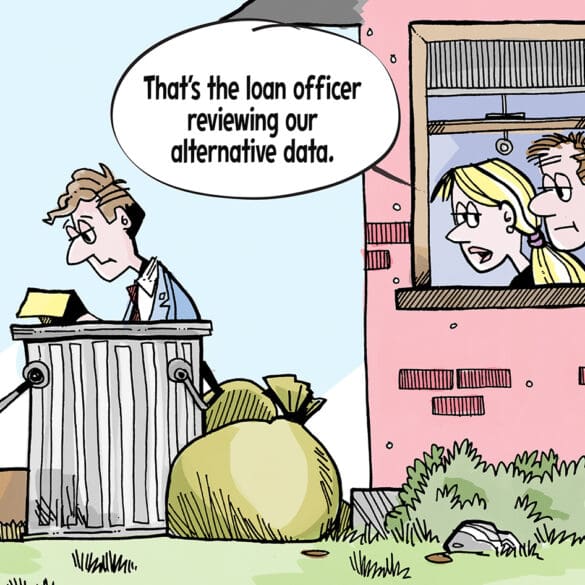

Fiserv unveils new digital mortgage product, giving credit unions a leg up With the $3 billion alternative data industry exploding,...

The desire for increased financial inclusion is a primary driver behind the increased use of alternative data in lending decisions, a new report from LexisNexis Risk Solutions finds.

People with higher credit scores are more likely to have grown up in an environment where they learned how to use credit to their advantage.

Freddy Kelly is the CEO and co-founder of Credit Kudos; Credit Kudos is an alternative credit bureau that uses open...

Fintechs have touted the importance of cashflow data in underwriting. This week, the CFPB published their evidence to support the approach.

Only 25 percent of the Chinese population is considered to have a traditional credit score; for non bank lenders gathering alternative data like transactions and social media has helped them to identify potential borrowers who the banks will not serve; Ant Financial has built out Sesame Credit who gathers this type of data and other online lenders have also begun using different data pieces to assess risk. Source.

[Editor’s note: This is a guest post from David Lin, Head of Credit at PayU. David is an experienced FinTech risk executive...

Indian banks are working with fintech startups to develop technology similar to what is used in markets like Africa and China; the banks hope to use social data and online shopping habits to underwrite borrowers; FICO recently began to offer credit scores in India using alternative data and there are many startups working on similar efforts. Source

Lenders today have a credit blind spot; this is because of the provision in the government stimulus package that allows...