HSBC’s U.S. retail division has struck two new financial health partnerships with Everfi and GreenPath Financial Wellness; “This is about...

Biz2Credit already works with HSBC and Popular Bank who leverage their software-as-a-service loan management, servicing and risk analytics product; with...

Jermey Balkin is the head of innovation at HSBC USA and a finalist for American Banker’s Digital Banker of the...

JPMorgan Chase, HSBC and Deutsche Bank are amongst a group investing $20mn in online shareholder platform Proxymity; the company is...

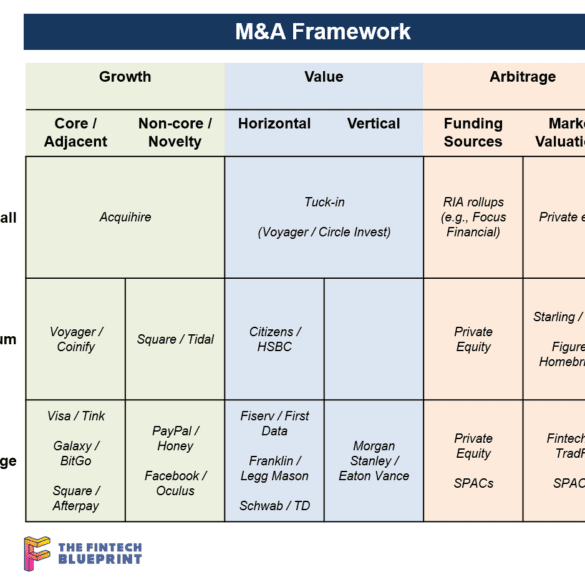

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

During a panel discussion at LendIt Europe in London representatives from leading incumbent lenders Lloyds Banking Group (LBG), ING, BBVA, HSBC, and Barclays discussed the challenges faces in the new digital world; topics discussed include cultural transformation, more power in the customers hands and trying to stay on top of the latest tech trends. Source.

Prime Minister Theresa May announced the start of the R5-SHCH Connect Partnership between London and China; the partnership will allow banks in China to have access to London’s foreign exchange market; the partnership is between London's R5 and the Shanghai Clearing House; companies involved include HSBC, LSE, BP, Standard Chartered and Standard Life Aberdeen; Jon Vollemaere, CEO of R5 commented to Finextra, “The new service offers benefits for all institutions trading FX. It provides Chinese banks with increased access to the global FX market, it enhances liquidity in major currencies, and it advances the internationalisation of the RMB.” Source.

HSBC announced Apple Business Chat was added to their suite of customer service channels; companies and their customers can use...

Financial crime fintech Quantexa raised a $64.7mn series C round from HSBC, ABN Amro Ventures, Evolution Equity Partners, Dawn Capital,...

HSBC has moved 3000 members of its staff into a new building and are viewing this digital group differently than their core suit-and-tie employees; the bank believes separating them out will better help to fuel new innovative ideas; HSBC CEO Stuart Gulliver said, "To survive for 150 years we've had to evolve. Most of the risk we've dealt with is political. Actually what's happening in the digital space is there is a threat, particularly to retail banking... in payments, in wealth management." Source