One of my biggest pet peeves in all of finance is the overdraft fee. I first wrote in 2019 that we were moving to a world of no overdraft fees. This was before major banks changed anything in response to the fintech push for no overdraft fees.

By 2021, it was clear that we had reached a tipping point on overdraft fees as many major banks either eliminated the practice or reduced the amount of their fees. This is partly due to the CFPB and their targeting of so-called “junk fees” like overdrafts. This has resulted in a dramatic drop in overdraft revenue for banks.

With this backdrop, I was interested in receiving an update from the Financial Health Network on overdraft fees as part of their annual FinHealth Spend Report (the full report will be out later this month). This report examines household spending on various financial products such as overdraft, payday and pawn, credit cards, and auto loans.

There were some very interesting findings in this report:

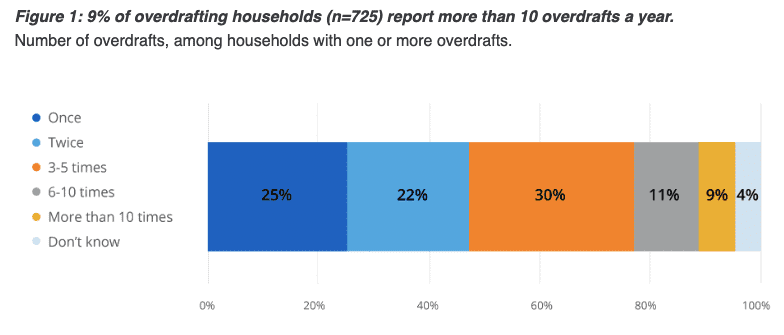

- 17% of U.S. households reported having overdrafted in 2022, unchanged from 2021

- 46% of Financially Vulnerable households reported paying an overdraft or NSF fee in 2022

- 9% of U.S. households that overdraft reported doing so more than ten times

It is the last point I want to focus on here. For the population who overdraft a lot (more than ten times a year), 35% of them said their last overdraft was intentional. So, they are using their bank account for short-term and costly funding. If you are talking APRs, this type of funding can go as high as 18,000%—no wonder the CFPB is cracking down on the practice.

For small transactions, those less than $25, 60% of respondents would have rather had their transaction declined than send them into an overdraft. But that means 40% of people are fine paying a $35 fee for overdrawing their account by less than $25.

We are moving towards a better system for overdrafts

Many fintech companies offer short-term financing when money is needed. Dave pioneered this product, but companies like Chime, Varo, MoneyLion, and Current all offer affordable small-dollar financing or fee-free overdrafts.

The report also shared that 81% of households overdrafted more than 10 times in 2022 prefer to incur a fee rather than have the purchase or payment declined. So, these people living on the financial edge are happy to pay a fee, but they really need a program that helps them get back on their feet.

It feels like we are in a transition period right now. The old overdraft system has been chipped away by fintechs, with many banks now jumping on board to offer no overdraft fees. But we are not yet where the most financially unstable people can rely on their financial institutions to provide inexpensive options.

I want to see a world where no financial institution can make significant money in fees off the most vulnerable subset of their customer base. It should no longer be expensive to be poor. We are on our way to this world, but more work needs to be done. This new report from the Financial Health Network makes that clear.