Estimated return for December 2016 production is 6.45%; PMI7, Prosper's underwriting model, was put in place late December, 2016; models are updated every 12 to 18 months; average FICO was higher than lows in 2015 and 2016 but is expected to decrease with an increase in lower grade loans as a result of the new credit risk model; prepayment rates increased and delinquency rates were lower; cumulative gross charge offs have increased but are expected to trend lower. Source

Estimated return on loan production in November 2016 was 6.58%, which is down from the previous three months; Prosper attributes its revised pricing and credit market trends overall to the month's weaker performance; the average FICO score in November was 714.2 which is approximately 10 points above the FICO scores in 2015 vintages; cumulative charge-offs are trending higher in 2015 and 2016 than 2013 and 2014; higher pricing is also a factor potentially affecting prepayment rates which are higher for loans originated in 2016. Source

Prosper released its October 2016 performance report with the month's estimated return of 7.12% just below the estimate of 7.17% for the third quarter; in October, vintage prepayment rates continued to trend higher; delinquencies and loss patterns since 2013 are below levels in 2012; cumulative gross charge-offs appear to be a factor trending higher; average FICO of the portfolio was 714.1 in October. Source

Crowdfund Insider talks with Ron Suber about Prosper and marketplace lending in 2016; in 2016 the firm reported decreased investment and transaction fee revenue which led to a number of new initiatives and changes; in his comments Ron Suber cited the importance of being adaptable to change; he also talked about the investment opportunity from institutional investors and the importance of securitization and a secondary market; for 2017 he expects rapid changes for the industry to continue and hopes that as the industry evolves it will result in more opportunities for borrowers, online lending platforms and the ecosystem. Source

eOriginal has added Ron Suber, Prosper Marketplace president, to its advisory board; the digital transaction document management company has been steadily expanding its business in the marketplace lending market; Ron Suber will help support the company's growth as an advocate for its unique digital documentation products also advising the company on the marketplace lending market overall; eOriginal is currently growing and expanding, also adding Jon Barlow, founder and former CEO of Eaglewood Capital Management, to its advisory board and raising $26.5 million in a recent funding round. Source

Prosper CEO David Kimball spoke at a conference last week stating, “Our main concern… it’s always liquidity, and I think most people in this room understand that the best way to get to liquidity is to have a lot of different options. And so I think you’ll see our toolkit expand [in 2018] versus where it is now.” Kimball also spoke about the challenges the company has had to overcome and the recent successes for the company including Prosper’s three securitizations and becoming cash flow positive. Source

Its platform focused on funding from fans for internet celebrities on YouTube, Twitch and other live streaming platforms; in August it raised 119.5 ether which is about $47,000; the SEC notified Protostarr of its investigation however a final status has not been reported; the firm says forming a legal department to manage the ICO investigation and potential need for registration is not within its short-term plans and it will refund its ICO investors. Source

Figure Technologies recently spun out their technology, Provenance Blockchain, as they aim to cut down 70 percent of closing costs;...

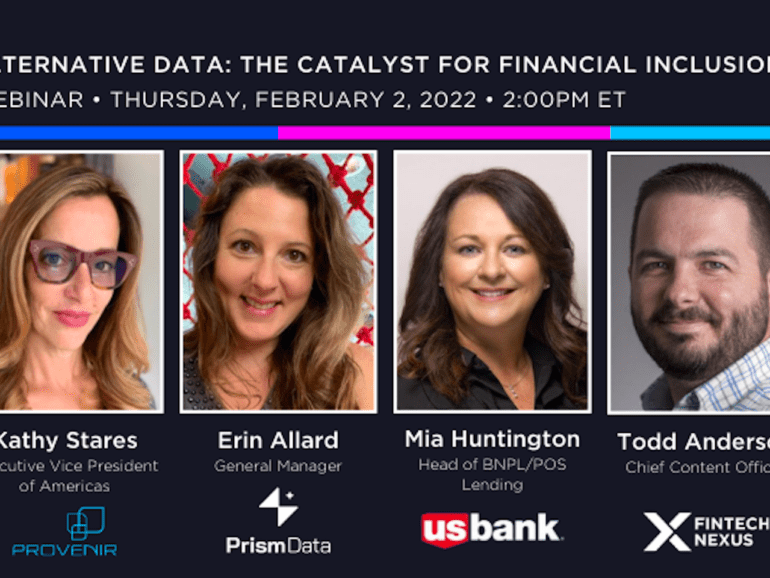

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.

Consumers have plenty of options when it comes to financial services; despite the success of fintechs around the industry, some...