Discover plans to use artificial intelligence in order to learn more about their personal loan applications; for instance, shopping at...

dv01 shared they have raised a $15 million Series B round led by Pivot Investment Partners and included George Soros’s...

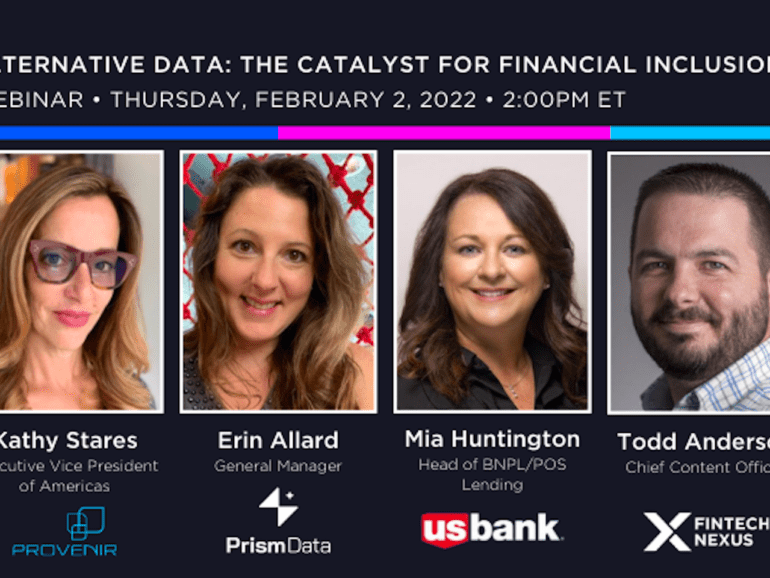

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.

'Lili Smart' tracks banking movements, categorising them instantaneously to ease small business accounting.

Avant will pay $3.85 million to settle with the Federal Trade Commission for allegations that it misled customers who were...

In a statement defending allegations against its issuance of new bank charters, the FDIC reaffirmed its authority to review and approve applications for US businesses seeking deposit insurance from the FDIC; the criticism comes from the OCC as it continues to develop plans for its national fintech charter; in a podcast interview Friday with a Commodity Futures Trading Commission official, Keith Noreika criticized the FDIC's process for chartering banks, suggesting that the open process was too long and cost too much for requesting companies eventually leading to many withdrawn applications; Noreika also said the OCC has proposed a bill that would take away the FDIC's role in approving newly chartered entities for deposit insurance. Source

American Banker takes a look at the new blockchain-based system for identity verification from Spring Labs; while 16 online lenders...

Arc were one of the self described first responders of the SVB crisis. They have now launched gold to help startups easily diversify risk.

Mastercard has teamed up with Urban FT and the payment services subsidiary of the Independent Community Bankers of America to...

Stash has announced it is rolling out new features for its 3 million users; the app will now allow users...