One of the primary reasons to not switch your bank is all the hassle that goers with changing direct deposit...

The Securities and Exchange Commission has at long last published their statement on the Framework for ‘Investment Contract’ Analysis of...

Bankrate reports that despite their limited resources community banks can effectively compete with big banks today; community banks have two...

Brett Boehm, principal and director of business development for TBF Financial, shares the various options that lenders have for non-performing loans; many firms chase non-performing loans when perhaps selling the loans to a commercial debt buyer is a better option; blog post discusses commercial debt buying, recovery options for the lender, and how to deal with reputable buyers and brokers. Source

OnDeck has achieved GAAP profitability and announced some interesting new developments for 2018. Source

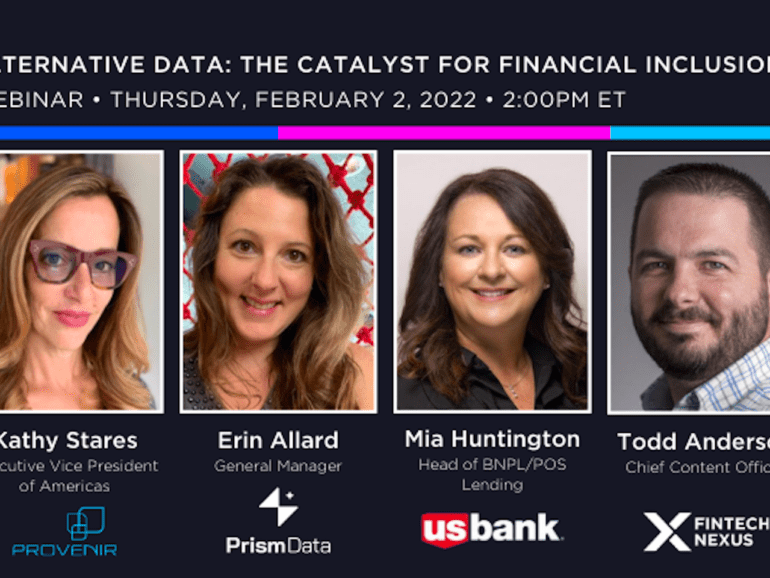

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.

CEO Brad Paterson Of Fintech Upstart Splitit On The Future Of E-commerce, Payments, Fintech, And BNPL (By Now, Pay Later)...

GreenSky, the point of sale lender went public today, raising $874 million; the company is profitable, has high margins and...

In episode 254 of the Lend Academy Podcast Peter talks with Clay Wilkes, the CEO and Founder of Galileo Financial...

Cross River Bank is leveraging its fintech customers to grow its payment transaction services; the firm has digital lending partnerships with 17 companies and is the issuing lender for some of the industry's top marketplace platforms; the firm's business relationships have helped to expand its payments system customers with many of its customers naturally migrating to Cross River Bank's payments system; the firm's CEO Gilles Gades says its payments activity could double next year with help from existing relationships with Stripe and Google Wallet providing access to Mastercard Send; in payments, Cross River currently manages approximately 2 million transactions per month and it sees a substantial opportunity for gaining more market share; industry participants are also watching Cross River Bank's plans for developing a newly branded bank called Almond Bank, which it has recently been investing in. Source