Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

This week, we look at:

The $12 billion in cumulative SPAC capital focused on Fintech, of which $3.6 billion has been raised in 2021 Q1 alone

Analysis of the private and public financial services markets and their valuations of profitability and revenue

A deeper look at the fundamentals and business mix of SPAC targets MoneyLion, Payoneer, Apex Clearing, and SoFi

Not everything that glitters is gold

A Team8 report charts the industry’s path by predicting what remains and changes while taking a few big swings at potential mega-trends.

Funding for Latin American fintechs surged in the first quarter, raising hopes that the worst for the industry may be behind it.

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

Today we're joined by Brett King, founder and executive chairman of Moven, one of the world's original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven's recent announcement to shutter its B2C business on episode 170 of Rebank. And we're happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

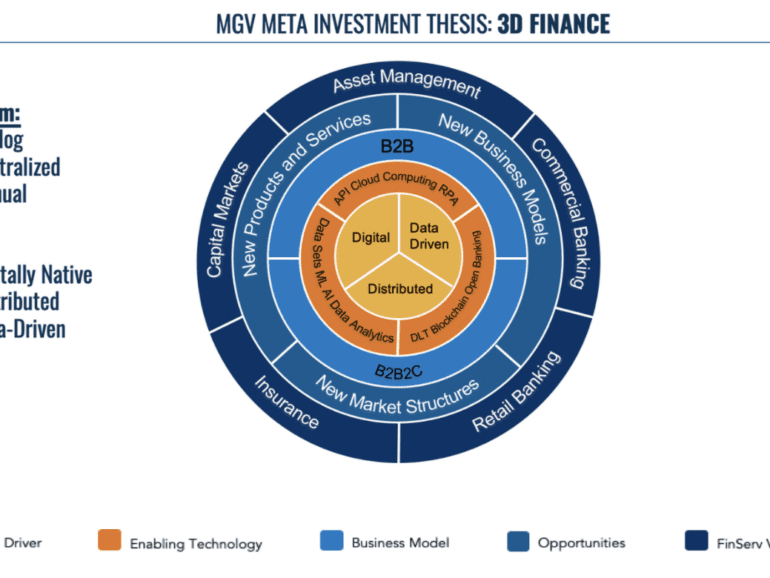

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

This week, we cover these ideas:

The difference between building a Fintech company, and building an empire to transform the world

How Warren Buffett is the best in the world at getting leverage through third party capital to grow

How Elon Musk is the best in the world at re-investing capital into his own judgment and view of the future

The $1.2B BitGo acquisition by Galaxy Digital, and the growing footprint of Alameda Research

DAOs as a way for all of us to participate

Colombian fintechs have been very active in the VC space in 2024, with a number of startups raising over $150 million in funding so far.