Instead of modifying decades-old transaction infrastructure, Spade provides better fraud protection by creating a new system. Customers like Sardine, Mercury, Unit and Ramp have improved their fraud models by more than 15% using Spade's real-time merchant intelligence for the card ecosystem.

Fraud is rising with the increased reliance on alternative payment methods, and AI could stop it. FIs have difficulties in adopting the tech.

artificial intelligencebig techdigital transformationenterprise blockchainidentity and privacyIndiaregulation & compliancetelecom & infrastructure

·This week, we look at:

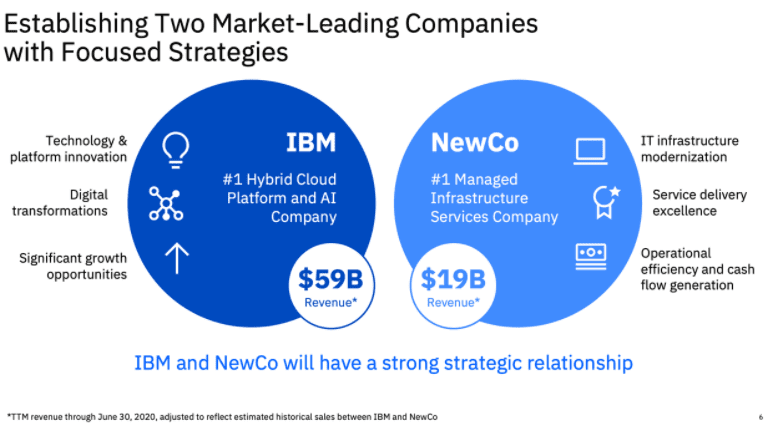

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

A recent book by McKinsey executives details the way to do digital and AI transformation. They enable and augment an existing strategy

Glia's voice banking solution extends its Al-powered virtual assistants to banking customer phone calls, replacing menu-based IVR technology.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

InformedIQ helps lenders find opportunities in today’s challenging environment while others pull back. The main difference is who embraces AI.

In this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

What we know intuitively, and what the software shows, is that the pixelated image can be expanded into a cone of multiple probable outcomes. The same pixelated face can yield millions of various, uncanny permutations. These mathematical permutations of our human flesh exit in an area which is called “latent space”. The way to pick one out of the many is called “gradient descent”.

Imagine you are standing in an open field, and see many beautiful hills nearby. Or alternately, imagine you are standing on a hill, looking across the rolling valleys. You decide to pick one of these valleys, based on how popular or how close it is. This is gradient descent, and the valley is the generated face. Which way would you go?

'The real power is that AI can actually predict or detect patterns of behavior and suspicious activity that would take a lot longer for traditional methods to uncover.'

Generative AI (GenAI) is the topic of the year, as more institutions turn to investment in the technology. This is just the beginning.