You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

In this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

GenAI has a lot of potential in financial services, but accuracy may be holding it back. Human interaction could help.

This week Isabelle sat down with Hummingbird's Joe Robinson to talk about. the development of GenerativeAI and ChatGPT.

Sift's latest Digital Trust and Safety Index describes how artificial intelligence (AI) is fuelling a fraud surge that will challenge retailers and financial institutions.

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

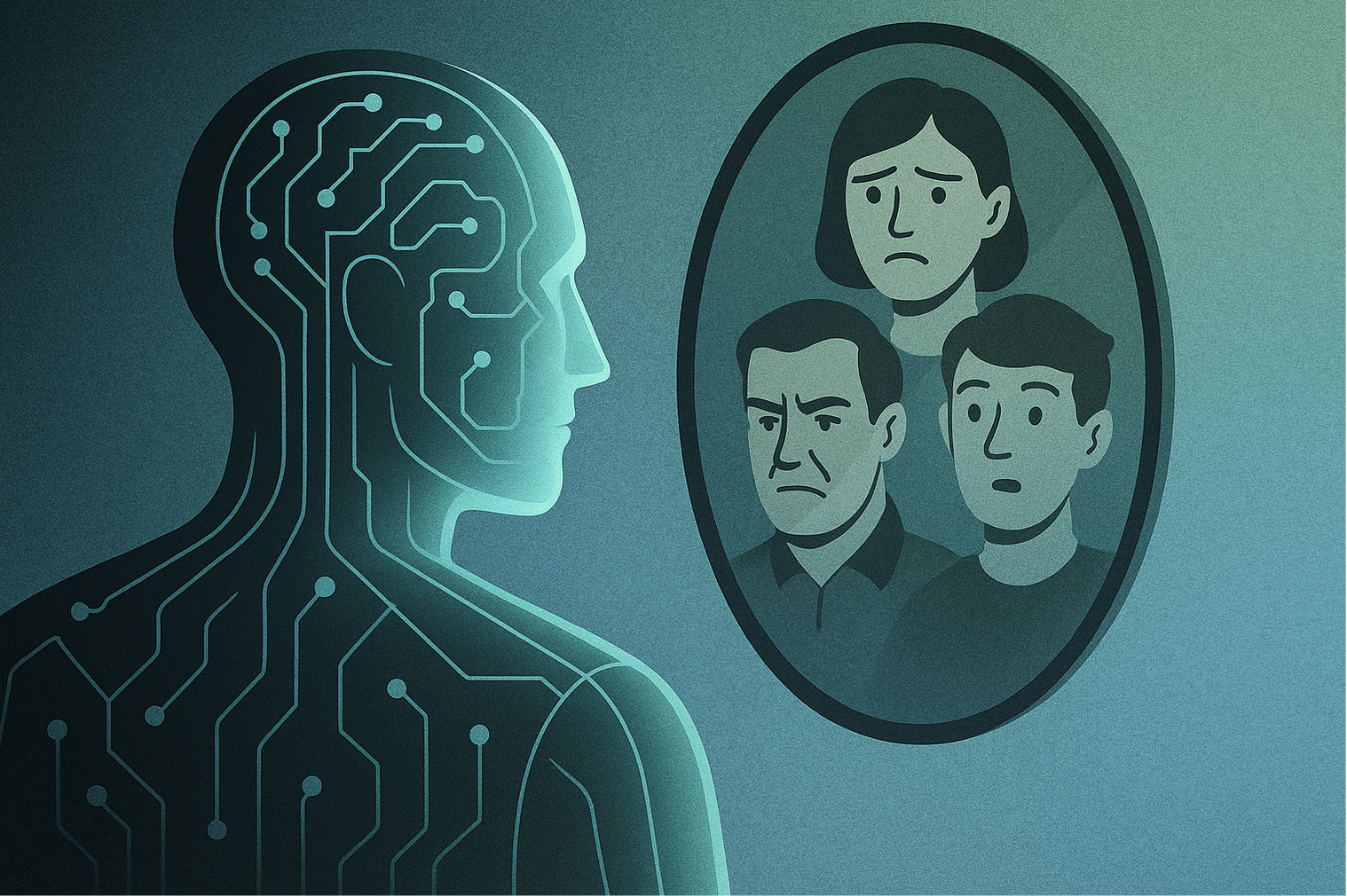

What we know intuitively, and what the software shows, is that the pixelated image can be expanded into a cone of multiple probable outcomes. The same pixelated face can yield millions of various, uncanny permutations. These mathematical permutations of our human flesh exit in an area which is called “latent space”. The way to pick one out of the many is called “gradient descent”.

Imagine you are standing in an open field, and see many beautiful hills nearby. Or alternately, imagine you are standing on a hill, looking across the rolling valleys. You decide to pick one of these valleys, based on how popular or how close it is. This is gradient descent, and the valley is the generated face. Which way would you go?

A poorly implemented chatbot will do more harm than good. Avoiding these five pitfalls increases the likelihood of success.

Focusing increasingly on customer-facing AI tools, Brex has launched an employee expense assistant that integrates into employees' day-to-day.

·

How sales and marketing teams can tap into AI to predict pricing pushback. A priority of Future Nexus, like many...