In news of cross-selling financial products across categories, roboadvisor Wealthfront has gathered a nifty $1 billion of deposit assets for its 2.29% interest-yielding non-bank cash account. Given that the firm has a little over $10 billion in managed investment assets, charges somewhere between 0 and 25 bps on those assets, and took years of wiggly pivoting to get to the current stage, it is fair to consider this influx a big win in terms of client traction. It is also $22 million of annual interest payments. A couple of things come to mind that are worth pulling apart.

I have been reading Alibaba: The House that Jack Ma Built this week, something everyone interested in understanding the future of Google, Goldman, Uber, or Amazon should do. The narrative starts with China's small business explosion, and Ma's genius is to tap into global demand for the products of those businesses through an online marketplace and associated financial services. But I am getting ahead of myself. Let's pause to acknowledge a massive, systemic transaction that was announced this week: payments processing company Global Payments acquiring TSYS (Total Payments Systems) for $21.5 billion.

Assurance came on my radar courtesy of Financial Technology Partners, which was the investment banker on Assurance's $3.5 billion sale to Prudential. Notably, the company is just 3 years old -- which comes out to a cool billion of enterprise value per year, likely a record comparable to the very few Ant Financials. Depending on the details, this is about $25 million of value per employee. So what does the company do? Simple, really. It is a destination website licensed to sell all types of insurance product (e.g., life, health, auto), with a clean onboarding questionnaire like any other roboadvisor, which then matches against policies on offer from third parties. AI and data science are used as the recommendation engine. It is a Kayak or Money Supermarket of insurance, simply designed, cleverly wired, with killer founders.

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

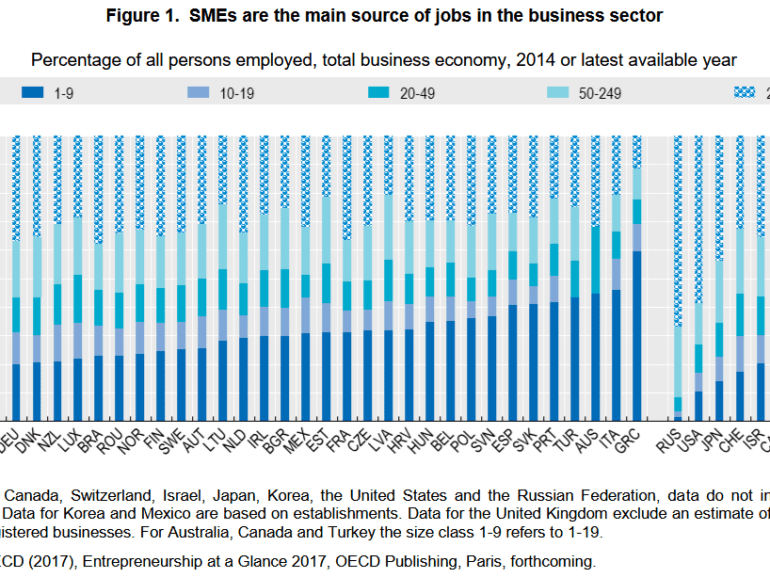

Anyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

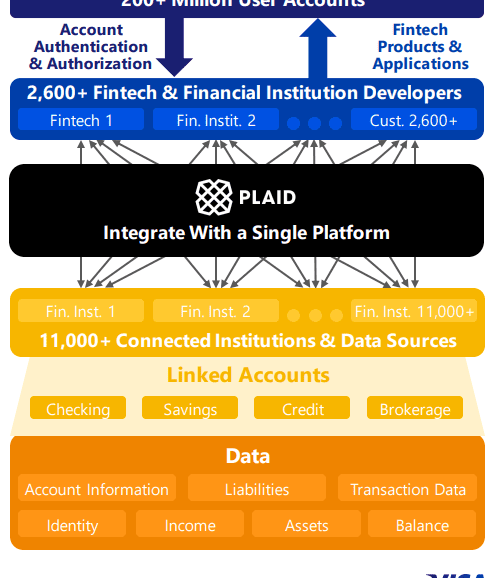

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

This week, we dive into the social, economic, and financial implications of data in a post-COVID world. As Apple and Google work to build out the government's contact tracing apps to combat pandemic, what Pandora's box are we opening without consideration? As Plaid reaches into payroll data to accelerate small business bailouts, what power do we hand to aggregators? Will dignity-preserving solutions come to market in time? The opportunity for decentralized identity and data storage is clearer than ever. Or will fear drive us to make permanent compromises?

Today, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?

This week, we consider the impact of financial infrastructure collapse and who really gets hurt through the lens of Wirecard, Enron, and Lehman Brothers. Yes, there are investors in the entity that will lose value. But there are also clients and counterparties of Wirecard, like Curve, Revolut, and Crypto.com. In the case of Lehman, there was a $40 trillion derivatives notional amount that took twenty years to wind down. We also consider the most recent $500,000 hacking in DeFi of an automated market maker to see if there are common threads to be drawn between the two worlds.

This week, we get philosophical and look at:

Embedded finance and how it will be woven into the fabric of the Internet

Applying the philosophies of existentialism, nihilism, and absurdism to Finance

Parsing symptoms in decentralized finance (Based Protocol) as artistic protest

Finding Dadaist beauty in chaos