Tether says it has conservative investments, while hedge funds question how much risk lies in the $82 billion investment portfolio that backs the currency.

French based DreamQuark is looking to provide an AI solution to banks, asset management firms and insurance companies; the product, Brain, helps financial services companies to make smarter decisions in fraud detection, anti-money laundering and credit scoring; they can also help to better organize data so firms can offer customers tailored products and cut down on false positives so consumers don’t need to call for verification purposes. Source.

U.S. Fintech ConnexPay Secures $7 Million Through Series A Funding Round Deep Dive: Small and local banks drive some of...

The platform grew 104% year over year; its investor base includes banks, pension and infrastructure funds, family offices and private clients; According to the company, LendInvest has the largest institutional funding base of any European Fintech lender on record; the platform offers loans made to professional property investors and developers. Source

UK-based fintech platform Revolut has offered the ability for their customers to buy and sell Bitcoin, Ethereum and Litecoin since...

Lend Academy interviews the CEO of BBVA’s new SME online lending initiative called Trustu; Vinacua discusses their innovation centers, how they interact with startups, why they decided to launch a platform, the social underwriting component of the underwriting and more. Source

Lloyds Bank partnered with Swedish fintech Minna Technologies and Visa in 2020 to launch its subscription management service, which allows Lloyds Bank customers to view, manage or amend their subscription services through the app.

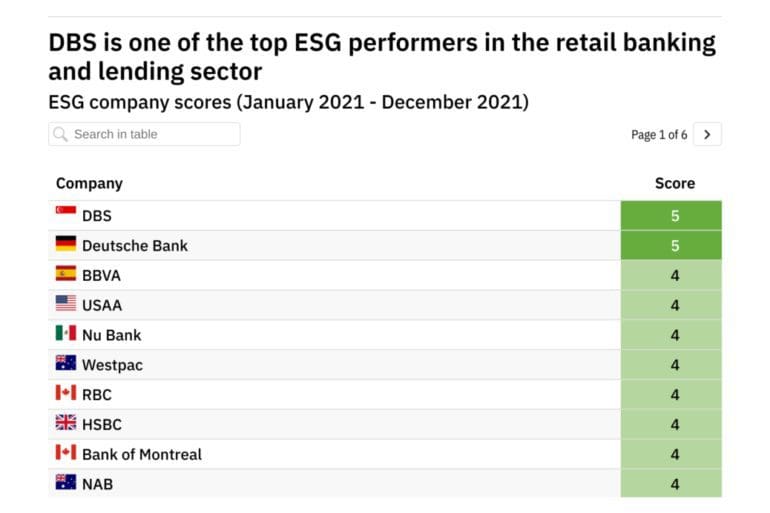

GlobalData research reveals which banks are best placed to benefit from ESG disruption within the retail banking sector

Over the last couple of years we have seen something of a converge between payments and credit businesses. We have...

Here are the most read news stories from our daily newsletter today: UK SMEs require human-digital banking blend, concludes Cynergy...