We haven’t written about Silicon Valley Bank in almost a year, but the saga of the third-largest bank collapse continues.

SVB’s parent company, SVB Financial Group, had $2 billion on deposit at its bank subsidiary. When the FDIC made it clear that all depositors would be made whole, one would assume that included the $2 billion of the parent company’s money.

But the FDIC has so far refused to pay. Now, the lawsuits are flying.

For a while, it looked like the parent company would get their money as $2.12 billion was moved to the bridge bank, and the parent withdrew $177 million. But then the FDIC halted those payouts.

Lawyers ?for SVB Financial Group argue that ?”the FDIC’s act was tantamount ?to theft” given the public assurances on the safety of deposits.

The FDIC is not commenting on the pending litigation. It will be left ?to a California court to decide.

Featured

> Investors Seek Billions From SVB’s Husk. Why Regulators Refuse to Pay

The dust had barely settled after Silicon Valley Bank’s collapse last year when savvy investors began lining up for a big payout, based on a hastily written government press release.

From Fintech Nexus

> The potential of digital wallets

By Peter Renton

It is time for digital wallets to come into their own. They can and should be more than a payment method, they could become the financial

Podcast

Mitch Jacobs, Founder & CEO of Plink on transaction personalization

The CEO and founder of Plink explains why even today banks are unable to fully utilize the card transaction data that exists…

Listen Now

Webinar

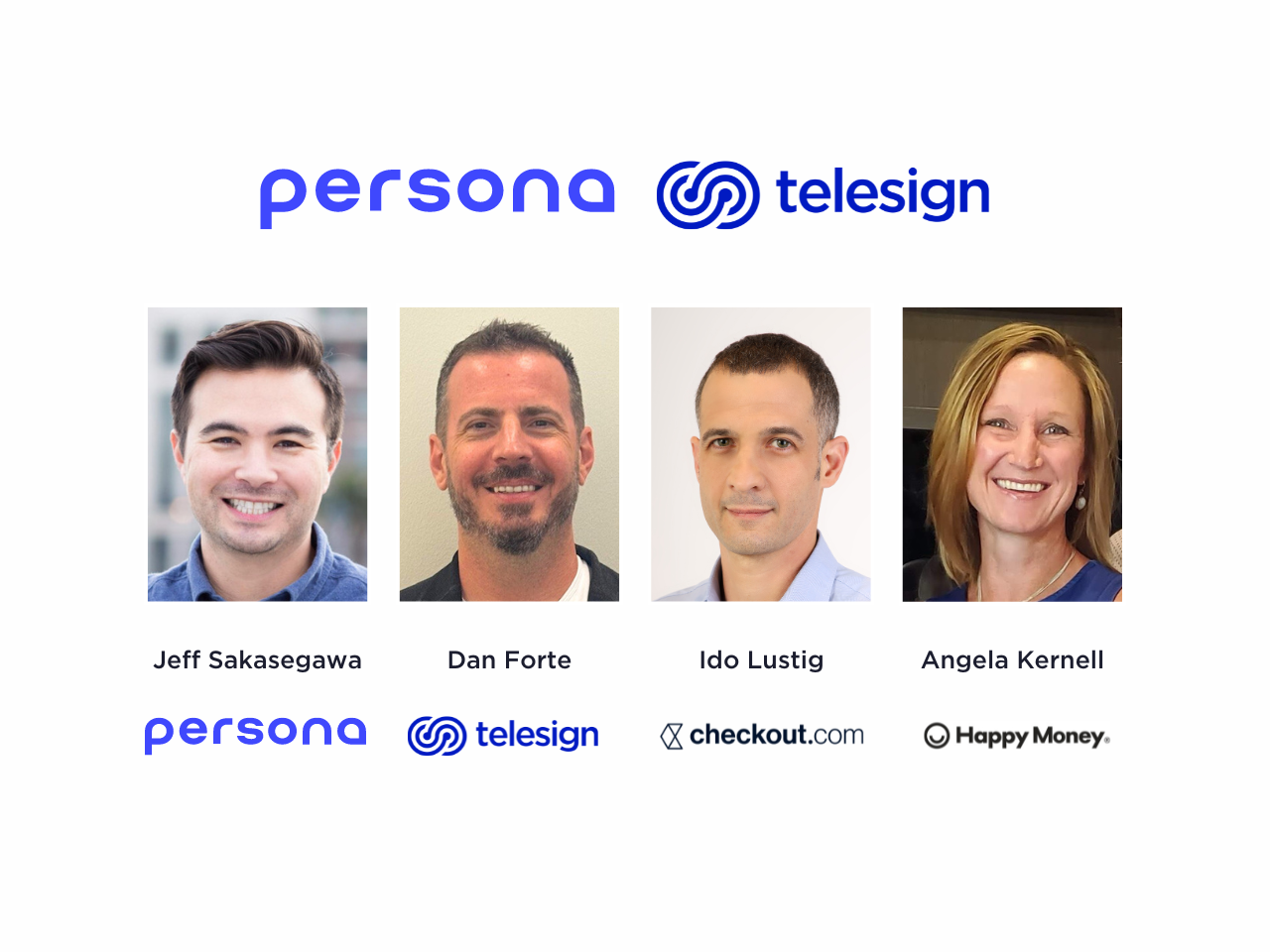

How to Maximize Conversions, Minimize Fraud at Account Opening

May 2, 2pm EDT

Both banks and fintech want onboarding new customers to be secure, simple and fast. But there is a delicate balance. Make…

Also Making News

- Global: After 6-year hiatus, Stripe to start taking crypto payments, starting with USDC stablecoin

The company announced that it would start to let customers accept cryptocurrency payments, starting with USDC stablecoins, initially only on Solana, Ethereum and Polygon.

- Global: Study Finds Only Half of Consumers Satisfied With Embedded Lending Options

Lenders in key global markets offer an ever-increasing range of consumer credit products. Still, consumers express dissatisfaction with the current options. Just 50% of consumers across six major economies are highly satisfied, with rates in Australia and Japan particularly low.

- USA: Bread Financial ‘feverishly’ preps for CFPB late-fee rule scenarios

Consumer spending slowed and charge-offs rose during the first quarter, but Bread Financial said a pending late-fee rule may not be as devastating to its revenue as the Columbus, Ohio-based firm initially feared.

- Global: Visa develops dashboard to make sense of stablecoin activity

Visa has teamed up with blockchain data provider Allium Labs to build a dashboard that helps people make sense of stablecoin activity.

- LatAm: Chilean FinTech pioneer Fintoc secures $7m for bold Mexican market expansion

Chilean FinTech startup Fintoc, which specialises in instant payments via APIs, has successfully raised $7m in a Series A funding round.

- USA: Stripe co-founder says high interest rates flushed out Silicon Valley’s ‘wackiest’ ideas

Rising interest rates in the past couple of years had a chilling effect on Silicon Valley, but Stripe co-founder John Collison said it was healthy.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.