India’s P2P lender Faircent first for RBI’s NBFC-P2P certification Cryptocurrency and a stock market boom pushes TradingView to $37 million...

Startup incubator Science is launching a blockchain incubation program, Science Blockchain, and will raise an ICO targeting $50 million to $100 million; the ICO will be SEC compliant as only accredited US investors will be able to participate; Mike Jones, founder and CEO of Science, tells the Wall Street Journal, "We believe that using an ICO as a vehicle and methodology for raising capital is the right way do it, it allows us to practice what you preach."; whether or not investors will make more money using this method of capital raising remains to be seen but the momentum in the blockchain space continues. Source

Crypto lending firm Celsius on Monday paused all account withdrawals, sparking fears that it may be about to go bust.

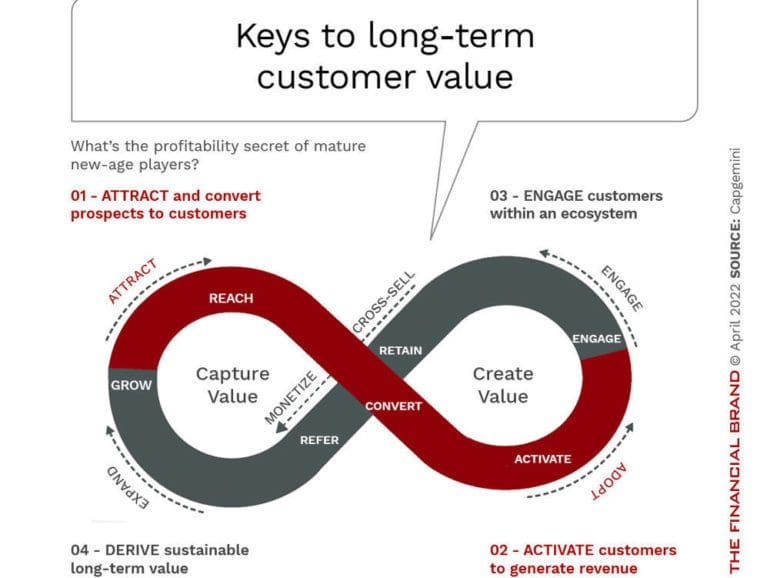

Personalization and engagement strategies not only support improved results in customer acquisition, cross-selling and loyalty, they are now a basic expectation of consumers.

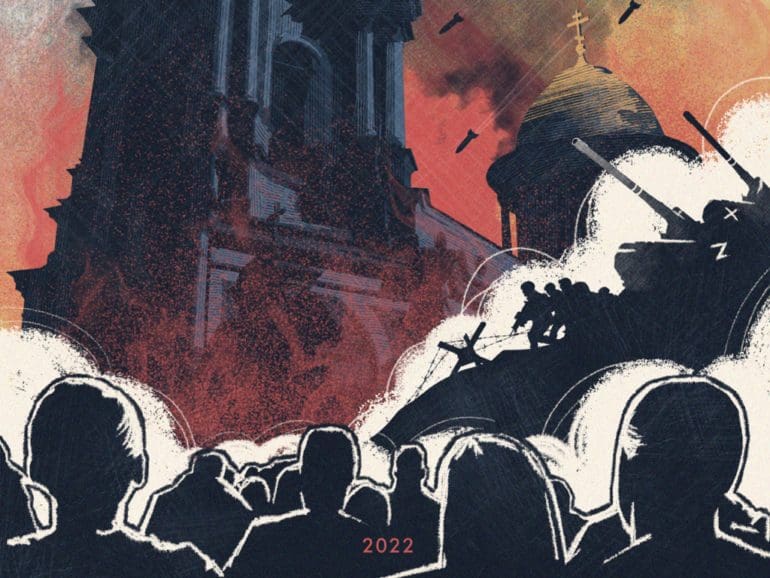

Fueling a renewed bull run, Ukraine used crypto to raise funds, while Russians bought crypto to evade their currency's collapse.

The new rule forces lenders to to assess whether borrowers can repay the loans and limits rollovers, where customers take out new loans to repay old ones; the new rule is likely to face legal challenges and is primarily focused on loans under 45 days. Source

USAA went live on Wednesday with a virtual assistant that works with Amazon's Alexa voice interaction device; Alexa will be able to answer commands from consumers who ask about accounts, balances, spending and transactions; USAA is now one of many financial institutions working with Alexa and as American Banker points out the USAA version is more flexible with voice commands than other institutions; when prompting Alexa they do not need to say the command a certain way, they can say the command as they wish; USAA is working with software company Clinc to customize their experience, as Jason Mars, Clinc's CEO, tells American Banker, "You've got this ability to speak to it in a messy, convoluted way, and the AI can understand everything, you feel like you're speaking to a human in the room." Source

There have been many recent launches of digital banks which was a result of regulatory changes in the UK; Metro Bank was the first having launched in 2010, but there are many new names since then; article highlights founders and investors in the space including Eileen Burbidge (Monzo), Sanjeev Gupta (Wyelands Bank), Jonathan Rowland (Redwood Bank), Nick Ogden (ClearBank) and the Pears family (Masthaven Bank). Source

Anchor cofounder and CEO Rom Lakritz has long been troubled by billing inefficiencies. Now that technology exists to solve it, he’s the perfect man for the job.

This week’s PeerIQ Industry Update covers the upwards revision of U.S. GDP growth to 2.9 percent from 2.5 percent; they provide a sneak peek into the PeerIQ Credit Facility Management Suite; Prosper announced 2017 results, former Avant founder John Sun raised $15mn for a new startup and the Arizona AG helped start the first fintech sandbox in a U.S. state in Arizona; Citi is building out their mobile app as the push by incumbent banks into digital becomes bigger. Source.