Both Lending Club and Prosper have announced several programs to help borrowers affected by Hurricane Harvey; Lend Academy shares an email to Lending Club investors which states approximately 30,000 live in the affected areas; Lending Club has made changes around collections calls, late fees, credit bureau reporting and hardship plans; Prosper has taken similar actions by waiving late and NSF fees as well as adjusting payment schedules. Source

StepChange partnered with Barclays to urge the government to proceed at pace with regulating Buy Now Pay Later (BNPL).

SMB lender Lendflow announced a partnership with Ocrolus to determine borrowers' viability and provide critical access to capital.

Last month, Citi Ventures, the U.S. bank's VC unit, announced an undisclosed investment in Belvo, a Mexican open banking infrastructure firm.

Many Americans saw their financial health decline in 2022, according to the Financial Health Network's Financial Health Pulse report.

Open banking regulation is moving forward with Colombia the latest to announce a plan to develop a framework for sharing financial info.

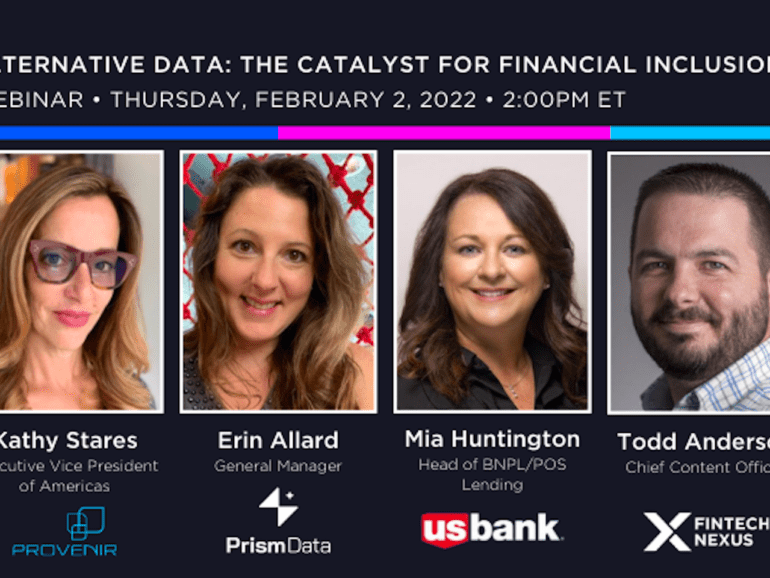

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.

Union Credit's platform provides credit unions with new, credit-worthy members by aggregating consumer data and matching it with various credit union fields.

Tala CEO Shivani Siroya not only points to the idea of building trust to grow a customer base but also belief in her instincts.

No More Content