Robo 1.0 success Personal Capital was acquired for nearly $1 billion by Empower, a major retirement savings manager. Softbank-backed insurtech darling Lemonade IPOed at less than $2 billion, in a successful fundraise and listing, and has since seen its market cap rise to over $4 billion. The IPO is a landmark for an insurtech industry in desperate need of successes. And PayPal announces the impending launch of crypto trading to its 325 million users. The move isn’t overly interesting in its own right, but the implications for the crypto space are worth exploring.

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

Looking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

We are syndicating a deep conversation across roboadvice, high tech and payments, and fintech bundling that we had with Craig Iskowitz of Ezra Group Consulting.

Check out Ezra Group Consulting here to learn more about digital wealth and Craig’s consulting practice. He is one of the sharpest software consultants in the RIA space, and his firm works with wealth management firms and fintech vendors to provide technology strategy and market research.

We had a lot of fun in this conversation and cover TD & Schwab, Wealthsimple, M1 Finance, Ant & Tencent, and Robinhood, among others. The full transcript is provided along with the recording — worth a read for the illustrations alone.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

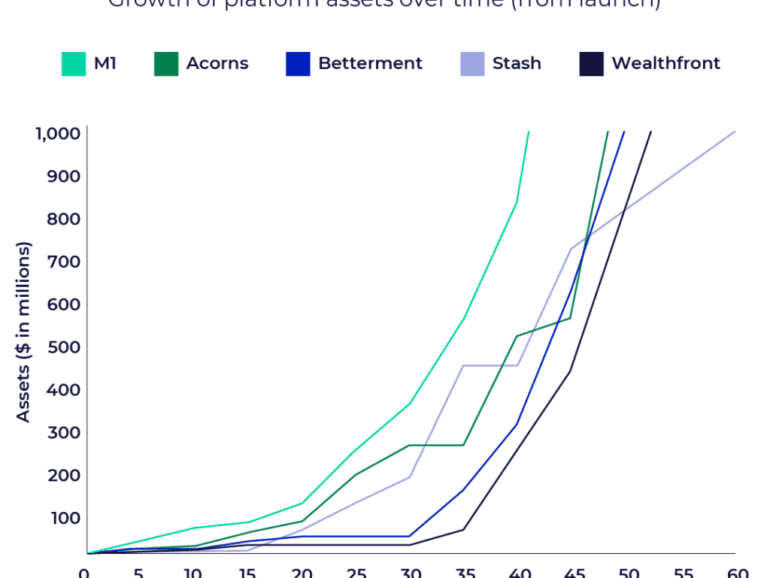

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

This week, we look at:

TikTok has become a platform with billions of views for investing and stock recommendations to teens. This emotional and persuasive labor can be traced from Jim Cramer to Roaring Kitty.

78% of Millennials (vs. 31% of Boomers) plan to use more digital tools in wealth management and 81% of them think that technology has made investing more efficient (vs. 61% Boomers)

This generational change has implications for investing technology, digital wallets, and the role of people in the financial advice process

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

In this conversation, we talk all things capital markets and investing with Yoni Assia, the founder and CEO of eToro, one of the fastest-growing and largest global digital investing companies, brokerages, and applications out there.

More specifically, we discuss the eating habits of Warren Buffet, community-driven investment challenging incumbent investing practices, the purposes of investing and trading, of financial health, of investment education, of gamification of investment strategy, of capital markets and GameStop and the connection between capital, memes and fashion, and finally machine learning’s influence of investment behaviour.