Cortex collaborates with several fintechs and giants of the financial market in Brazil, such as BTG Pactual and XP.

Chile's fintech Migrante to acquire a motorcycle loan startuup in Colombia. It also changed its name to Galgo, or "greyhound" in Spanish.

While VC funding to Latin American startups saw a year over year decline, the fact that it is stabilizing offers hope to the industry.

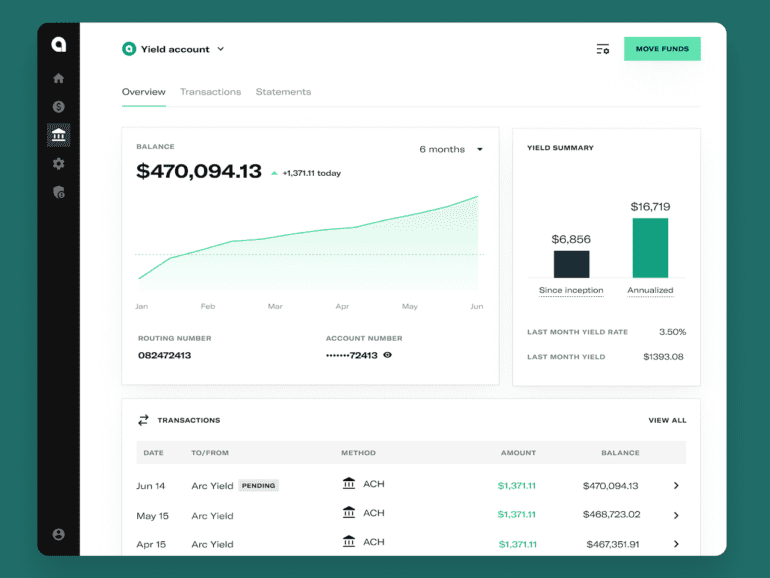

The day after The Fed announced yet another (albeit smaller) rate hike, Arc launches a high yield account so startups can gain on idle cash.

Early stage founders face a challenging climate and many lack the expertise to drive growth.Support from an experienced hand may be critical.

For entrepreneurs looking to overcome these challenges, revenue-based financing is a compelling alternative.

The ten fintech firms selected will work closely with 40 plus institutions

Including AIG, Bank of America, Fidelity, & JP Morgan.

With this capital injection, Racional will seek to double its team in the short term and reach 100,000 users in Chile, Brazil, and Colombia.

Transfeera, a banking-as-a-service provider in Brazil focusing on B2B transactions, raised $ 1.3 million this month in a series A round.

In celebration of International Women's Day we provide some suggestions for female founders in fintech to help grow their startups.