The Cash App is a consumer finance app owned by Square; the company opted to take a different approach to...

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

exchanges / cap mktsidentity and privacymarketingMetaverse / xRNFTs and digital objectsSocial / Communityvisual art

·The structure of capital markets precedes the innovations that come from it. High frequency trading, passive ETF investing, SPACs, and crypto assets all telegraphed their value proposition before becoming large and meaningful in scale. We are now seeing a new market shape emerge, one that starts with community and builds up into financial instruments that are cultural and social. This analysis looks at the most recent developments in the overlap between decentralized social and cultural work and related financial features.

TikTok has been falling short, and banks need to step up. Here's how they can learn from financial influencers and help customers.

The first week of the year is in the books and already there has been big news in fintech.

Today, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

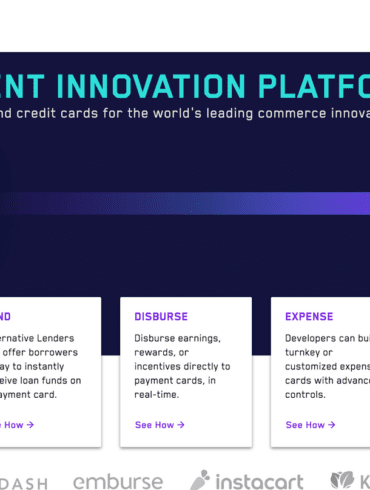

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?

Fintech startup Tally has started to see big success in advertising on TikTok which has allowed the company to more...

TikTok has fast become one of the most popular apps in the world and is said to be valued at...

This week, we look at what positive innovations could arise from the pressure cooker of the pandemic. I touch on health care data and privacy, molecular technology, digital work- and play-spaces, and their financial implications. Channeled productively, the next decade could see advances in these fields that we can't yet imagine.

If you are in finance and only looking at banks, you are missing out on the real change agents. Here's some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.