PayPal recently disclosed that they had crossed $10 billion in originations which makes them the leader when it comes to...

In 2017, SoFi spent $170 million on marketing and paid $756 to acquire each customer; in 2018 the company plans to spend $200 million; in comparison LendingClub and Prosper spent between $350-$450 to acquire a customer; back in 2015, SoFi spent $30 million on marketing and $375 to acquire a customer; at the time marketing spend as a percentage of originations was 0.6%; SoFi’s marketing strategy is different than other fintech firms who often show up on rate comparison sites. Source

Real estate analytics fintech HouseCanary has announced a fresh funding round of $65mn led by Morpheus Ventures, Alpha Edison and...

Join LendIt for a webinar about blockchain technology and how it can streamline operations for wealth managers and insurance back office operations; register here for the August 14 webinar at 2:00 PM EST; presenters include Jayant Khadilkar, global head of analytics and technology at Tiger Risk, and Ryan Rugg, business development at R3. Source

USAA went live on Wednesday with a virtual assistant that works with Amazon's Alexa voice interaction device; Alexa will be able to answer commands from consumers who ask about accounts, balances, spending and transactions; USAA is now one of many financial institutions working with Alexa and as American Banker points out the USAA version is more flexible with voice commands than other institutions; when prompting Alexa they do not need to say the command a certain way, they can say the command as they wish; USAA is working with software company Clinc to customize their experience, as Jason Mars, Clinc's CEO, tells American Banker, "You've got this ability to speak to it in a messy, convoluted way, and the AI can understand everything, you feel like you're speaking to a human in the room." Source

Fintechs PayPal and Intuit were the first two non-bank lenders to be approved to lend through the Small Business Association’s...

European challenger bank Revolut announced today that it will enter the US market with crypto trading services through a partnership...

Survey provides insights on investors preferences for investing in real estate and demand for technology; the report shows only 2% of participants are very familiar with real estate crowdfunding providing opportunity for greater awareness of real estate investment platforms; additional highlights include statistics on investment performance perception, interest in real estate technology and thoughts on house flipping investments. Source

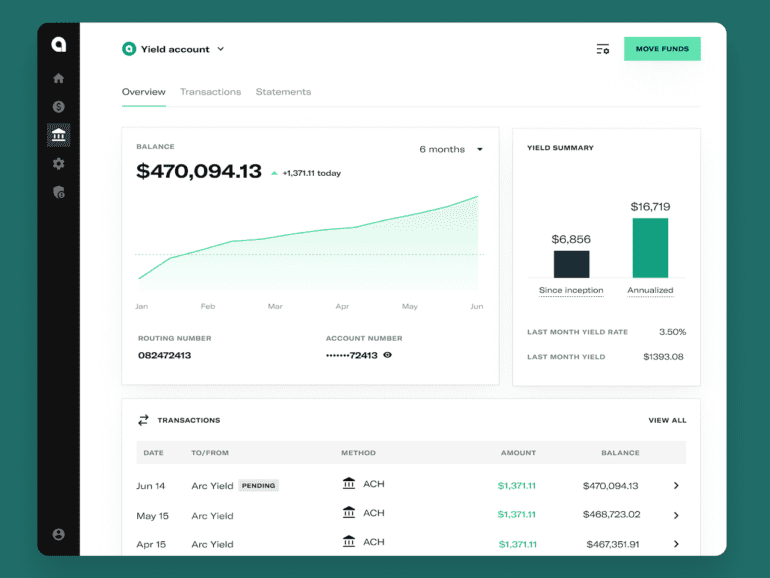

The day after The Fed announced yet another (albeit smaller) rate hike, Arc launches a high yield account so startups can gain on idle cash.

LoanClear is a servicing company which was spun out of Dynamic Credit; now the company is acquiring Brismo, a provider...