Last week Lending Club announced they would be adding 15 new fields to their API. Investors who invest directly on LendingClub.com will see three of these fields on the browse notes page. For third parties who create credit models and individual investors who rely on their own backtesting to beat an index of loans this is great news. In addition, FOLIOfn has released an official API for secondary market trading. We review both of these developments below.

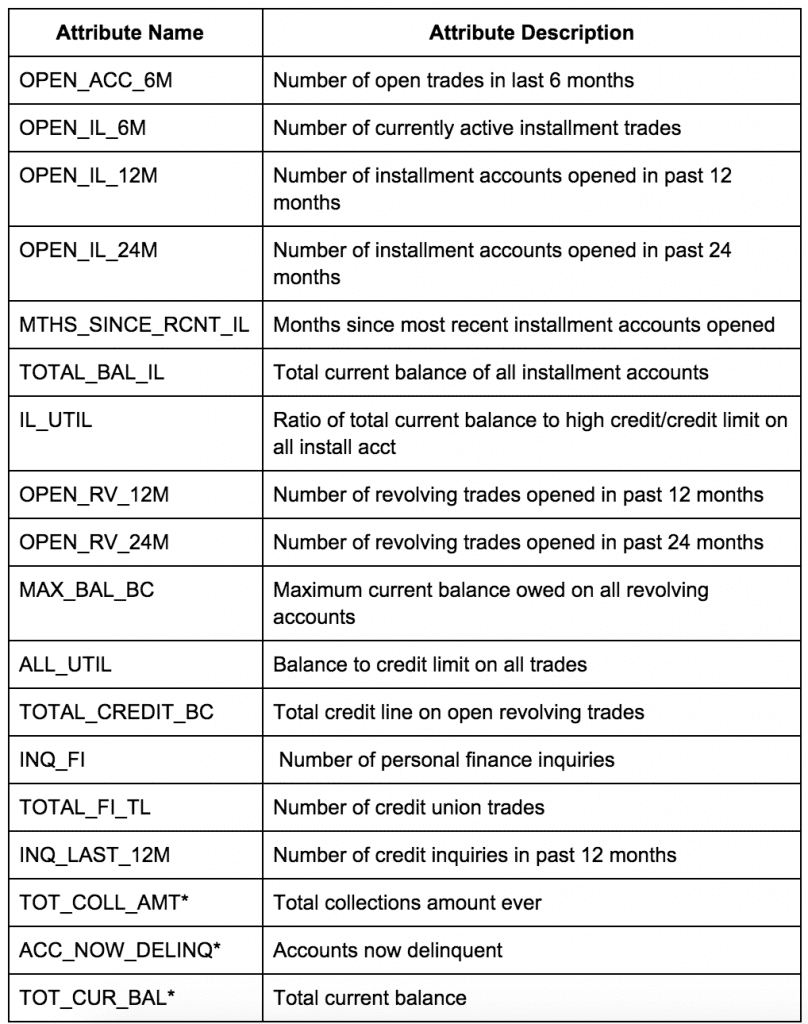

New Lending Club Fields

At a time when platforms have been increasingly protective over their data, Lending Club’s move to be more transparent is a welcome change. The three fields were made available November 11th, but the remaining will be added to the API and download notes file within the next month.

Fields marked with * will be added to the browse notes page.

I reached out to Emmanuel at LendingRobot to get his thoughts on the new attributes:

We plan to train our model on those as soon as we have enough data. We may also add new filtering criteria, but will let our users decide which ones they’d like us to add. Usually it’s easy for us to expose new filtering criteria, so we’re pretty reactive.

Lending Club Secondary Market API

It means for us that automating the secondary market will be faster and more reliable. At first, our clients won’t see much since everything is ‘under the hood’. But with easier and faster ‘put for sale on the market’, we plan to soon release the ability to put an entire portfolio for sale, all the time. Imagine that all your notes will be listed on the secondary market, with some smart pricing, so as soon as a loan becomes late the asking price will go down. This is an important step for us toward optimizing returns while still offering a super-simple experience.

Automated buying and selling on the secondary market is a step in the right direction. However, the dramatic change will come only when we can access the buy/sell history for the secondary markets. Our clients desire the agility that comes with liquid secondary markets, and we are working hand-in-hand with our partner platforms to deliver just that.