The Cambridge Centre for Alternative Finance together with the Australian Centre for Financial Studies at Monash University and Tsinghua University today released their second annual alternative finance report.

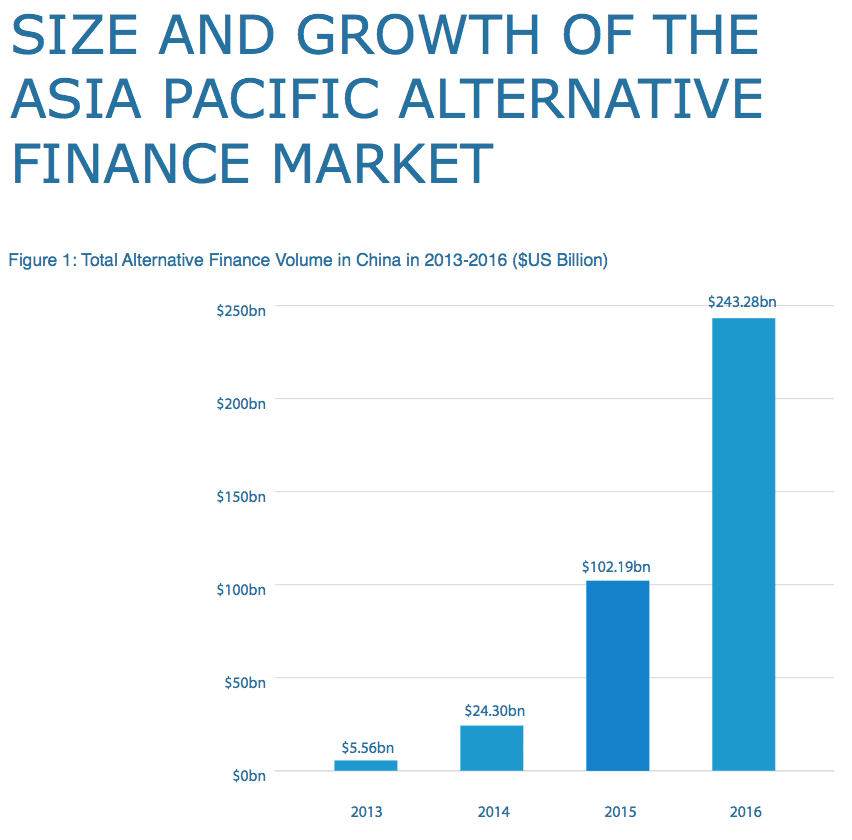

Alternative finance volume totaled $245.28 billion in 2016, up from $103.31 billion in 2015. It’s amazing to see alternative finance continue to grow in the region. Not surprisingly, China is the main driver accounting for 99.2% of the total Asia Pacific market. China represented approximately 85% of the entire global market in 2016.

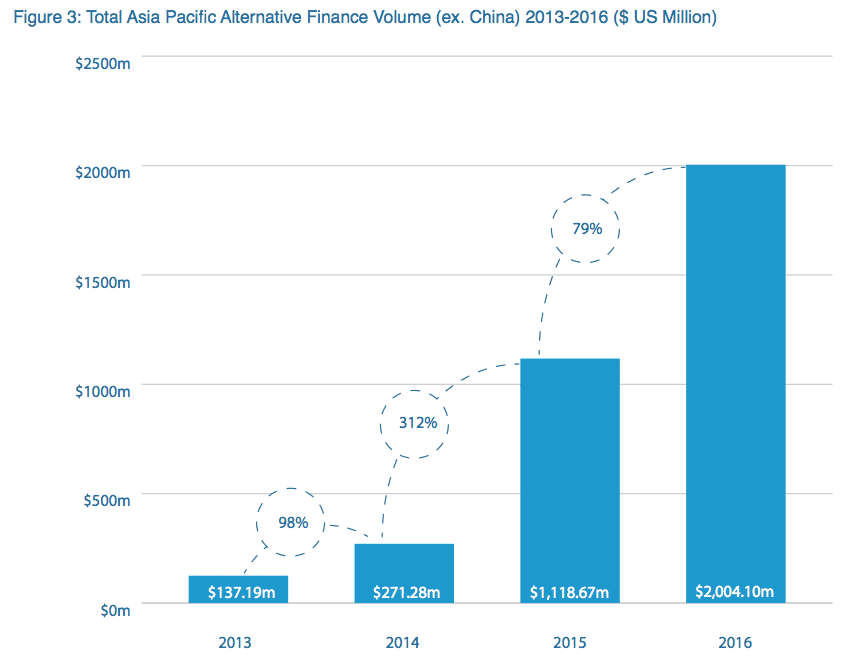

While China overshadows the other countries due to the sheer size, volume continues to grow outside of China. According to the report:

Australia was the second largest alternative finance market with US$609.6 million in 2016, followed by Japan in third with US$398.45 million and in fourth South Korea with US$376.31 million, New Zealand in fifth with US$223.25 million, Singapore in sixth with US$163.75 million and India in seventh with US$124.16 million.

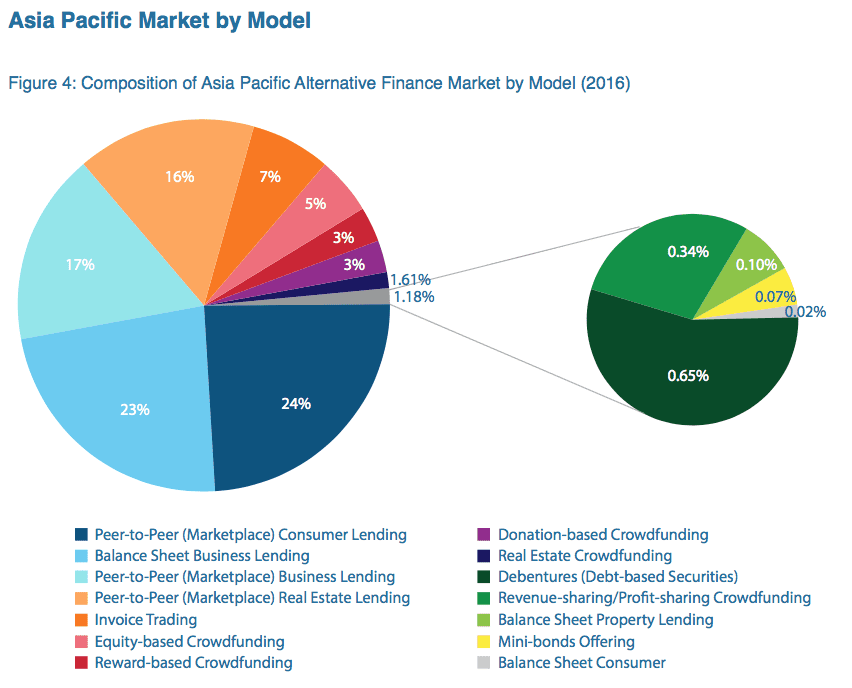

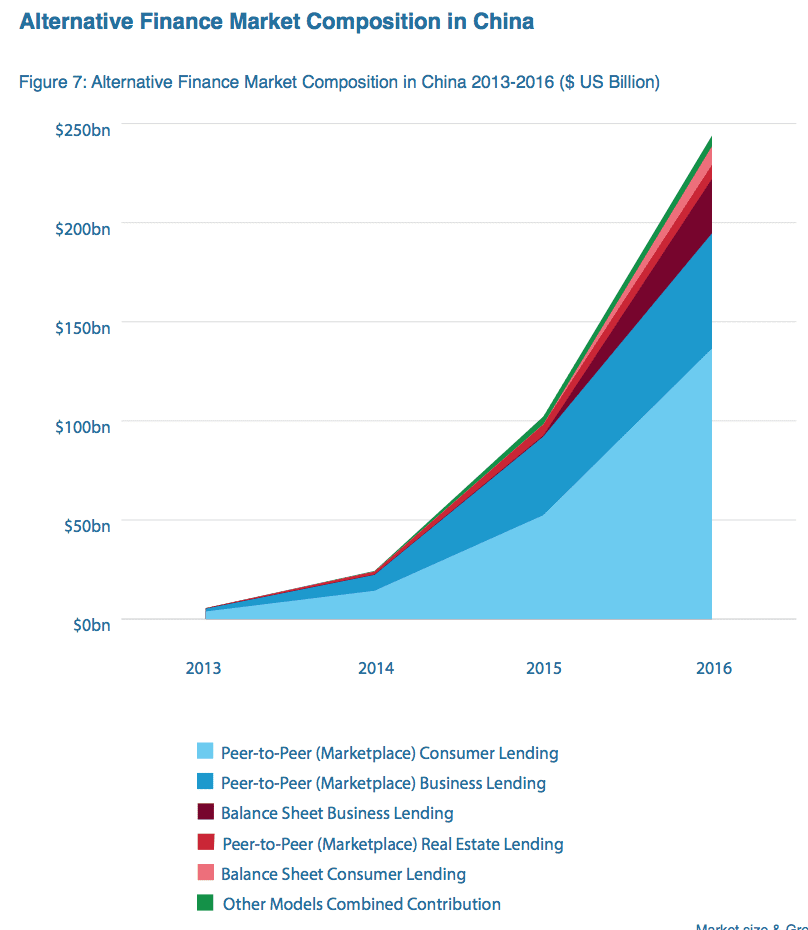

It’s also interesting to see the verticals within alternative finance that have the most traction. Below are two charts showing the split among the entire Asia Pacific region as well as China.

Other findings from the report include:

- China continues to see “distinctively low levels” of institutional participation in alternative finance compared to other markets such as the US and UK, with only five per cent of peer-to-peer business lending coming from institutions in 2016. Online lending models in China are led by individual retail lenders.

- In the Asia Pacific outside of China, about $1.5 billion was raised by businesses through alternative finance channels, up 72 per cent from the previous year, with an estimated 43,000 business entities utilising alternative channels of business finance.

- In China, 72 per cent of peer-to-peer consumer lending platforms see cyber-attacks as the biggest threat to the industry, while more than 50 per cent across all platforms in China see current and proposed regulatory norms to be adequate.

- Outside of China, 69 per cent of platforms in Japan see existing regulation as inadequate or too relaxed, while in Singapore, Australia, New Zealand and Malaysia around two thirds of platforms see current regulations as adequate.

Conclusion

The amount of growth, particularly in China continues to impress. We’ve known for many years that China leads the world in terms of marketplace lending volume but this report digs further into the market there. And seeing the numbers excluding China shows how much more potential there is, particularly in countries like Singapore and India. If you’re interested in learning more about the report’s findings you can download the pdf from the University of Cambridge website.