Block revealed it had beat forecasted earnings during its Q2 2023 call yesterday, August 3, despite the challenging economic backdrop.

It was reported that quarterly net revenue was up on last year, reaching $5.53 billion. All but hardware revenue had increased year on year, hinting at the rising levels of competition in the POS space.

Adjusted operating income had also bounced back from a $103 million loss in Q2 2022, to $25 million.

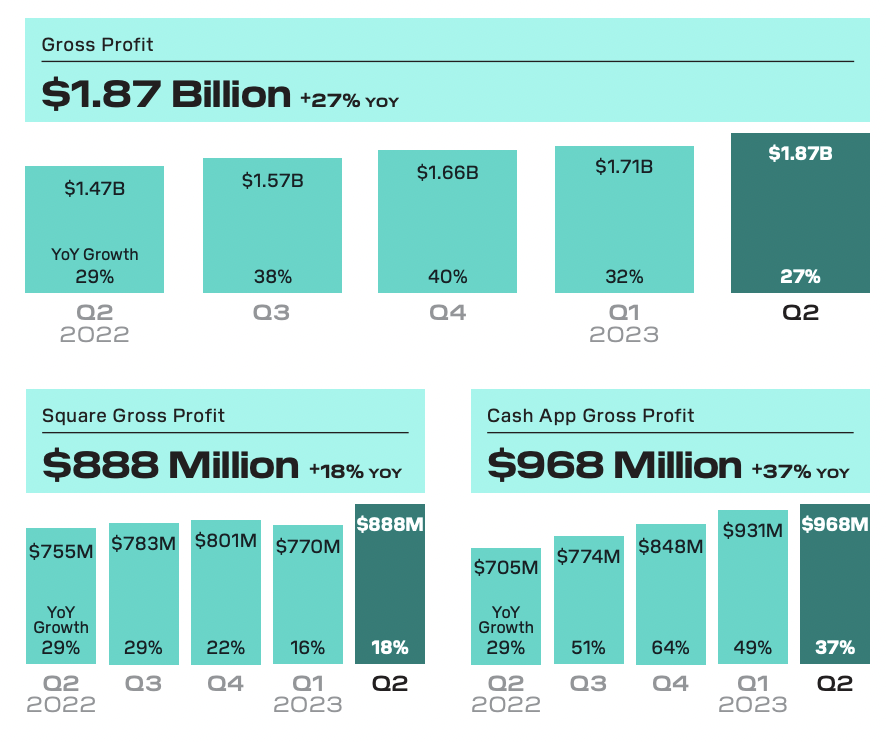

Gross profit grew 27% to $1.87 billion, with both Square and CashApp registering consistent profit growth. The company stated that Square, in particular, had shown “strong momentum” which was driven primarily by Square Loans, Instant transfer and Square Debit Cards.

“As a company, our strength and resilience comes from our diversified ecosystems, each serving different audiences and the connections we create between them,” said CEO and Founder, Jack Dorsey.

The company has stated that it will embark on a “disciplined” strategy going forward, weathering the challenging climate.

“Winding Down” BNPL in Europe

“This past quarter we decided to wind down operations in certain markets, including Cash App’s Verse brand in the EU, and our Buy now pay later platform ClearPay in Spain, France and Italy,” said Dorsey. “They have required significant investment and the markets have not seen the growth and profitability we had expected over the past several years.”

“We see an opportunity to shift these resources towards strategic areas that have a higher potential return on investment.”

The high-profile, $29 billion acquisition of BNPL provider Afterpay (ClearPay in the EU) in 2021, has proved to be a challenge for Block. A cooling of the hype around BNPL and heightened competition with companies like Apple have made growth rates far from ideal.

In the last quarter, seriously delinquent loans (151-180 days past due) had also spiked, reaching over $35,000, an all time high in the past year.

It has not gone unnoticed. Dorsey stated his current priority was the Afterpay platform.

“This is where a lot of my focus is right now,” said Dorsey. “I’m meeting the team almost on a daily basis to make sure that we come up with a compelling and differentiated experience.”

A key factor, he stated, would be the connection of its US CashApp with users of Square’s payment terminals through Afterpay.

Bitcoin Bet Pays Off

However, it seems Block’s focus on Bitcoin is paying off, with Bitcoin revenue now making up almost half of its quarterly net revenue.

The company first invested in bitcoin in 2020, consistently adding to its commitment over the following years. In December 2021, the company changed its name to Block, which some have seen as a signal of its ongoing support of Web3 technology.

Earlier this year, Block announced their development of bitcoin wallet, Bitkey, that would integrate into CashApp. Partnering with Coinbase, Dorsey stated during the call that it would be launched internationally from the start and added to the dynamism of the company.

“We continue to refine (the product strategy) and look for opportunities to build a really compelling experience within the Cash App. That build network effects and increases are network effects within Cash App, but also enables us to have an app that people are checking every day,” said Dorsey.

RELATED: Block shows resilience and a refocused investment framework