Happy Halloween everyone. October is in the books and there is nothing spooky about the results from Lending Club and Prosper. Together they issued $273.1 million in new loans up from just $97.4 million a year ago, a 174% increase. Despite the larger numbers the rate of growth is not slowing down – for most of this year the combined annual growth rate has stayed between 160% and 180%.

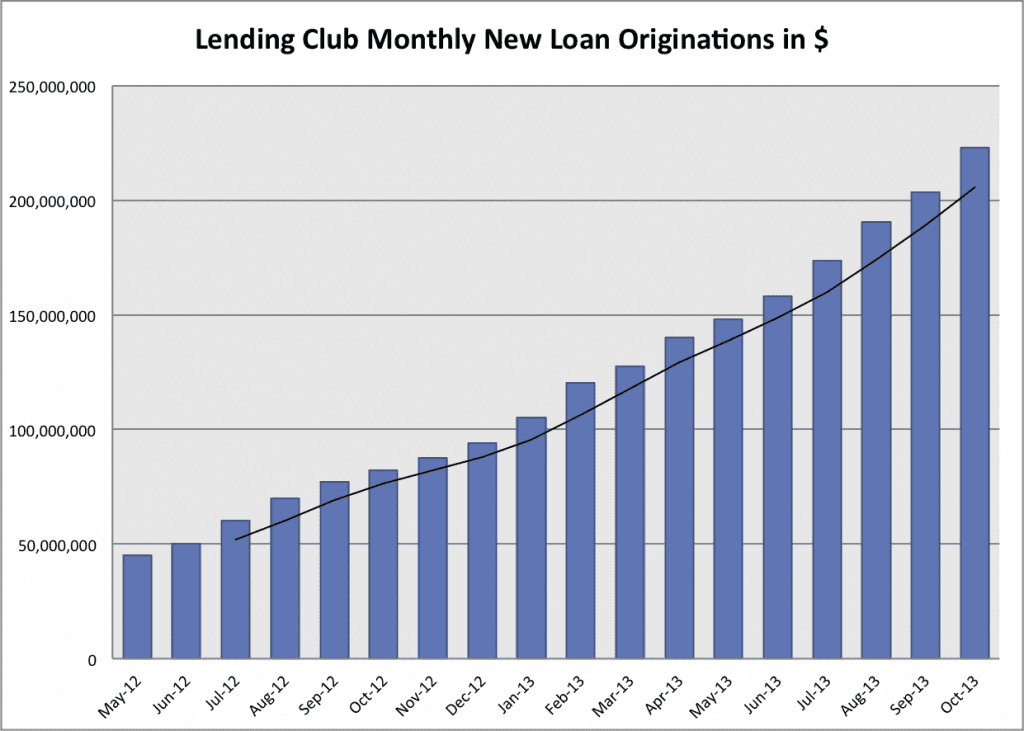

Lending Club Issues $223.1 Million in New Loans

October was another very solid month for Lending Club. Loan volume was up 9.7% over the previous month to $223.1 million with the number of loans issued growing to 16,247.

The big change for investors at Lending Club this month was more loan availability. In August and September the number of available loans routinely dropped to less than 50 before the new batches were added. Not so this month. Often we went over 500 loans available and we averaged probably 200-250 loans throughout the month.

I chatted today with Scott Sanborn, Chief Operating Officer at Lending Club, to find out what was behind this increased loan availability. He said that Lending Club has been working with their large investors to delay their deployment of capital and to stage new capital coming in over a longer time period. At the same time they have been working hard to increase the borrower volume. He emphasized again that Lending Club is committed to the retail investor and that was the driving force behind these changes.

Below are some stats from October for Lending Club as well as their 18-month chart. The black line in the chart below is the three month moving average.

Average loan size: $13,729

Percentage 36/60 month loans: 74.5%/25.5%

Average interest rate: 16.1%

Percentage of whole loans: 34.4%

Average FICO score: 699

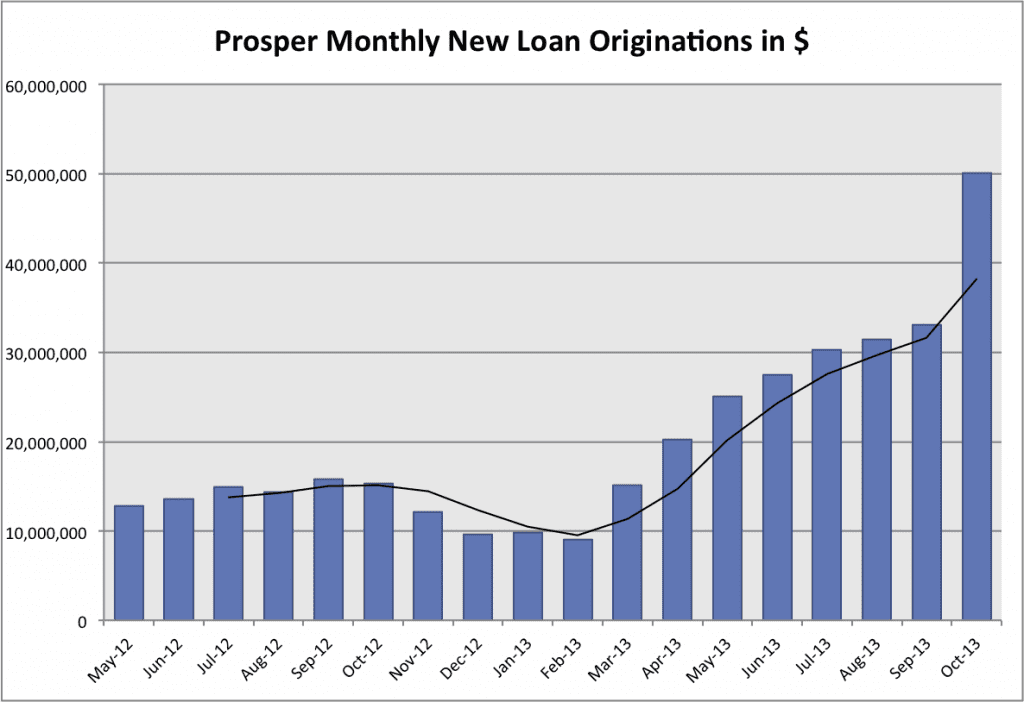

Prosper Hits $50 Million up 51% Over Last Month

As I wrote about earlier this week Prosper has had a spectacular month. Not since the very early days of p2p lending in this country has any company grown so fast in just one month. In September Prosper issued 3,149 new loans totaling $33.1 million. This month Prosper issued 4,774 new loans totaling $50.1 million. That is a 51.6% increase in the total number of loans and a 51.3% increase in total dollar value of loans.

Back in February when I met with Prosper’s new management team for the first time, Ron Suber, their Head of Global Institutional Sales, made some bold predictions. Back then Prosper’s loan volume was languishing and they would issue just $9 million in new loans that month down 43% from their peak five months before. Prosper had been going backwards.

Despite that, Suber told me that Prosper would do $15 million in March, $30 million by July and $50 million by the end of the year. At the time I dismissed these predictions as ridiculously optimistic. Nearly 500% growth in less than one year was just not going to happen in my opinion.

Well I am happy to report that I was completely wrong here. While Prosper hit Suber’s projections right on target for March and July even he was too pessimistic on their timetable towards $50 million. Prosper achieved that goal two months ahead of schedule. Here is their press release that came out earlier today about hitting this milestone.

Below are the statistics for Prosper this month as well as their 18-month chart.

Average loan size: $10,517

Percentage 36/60 month loans: 67.1%/32.9%

Average interest rate: 18.7%

Percentage of whole loans: 62.9%

Average FICO score: 695